Square Enix 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

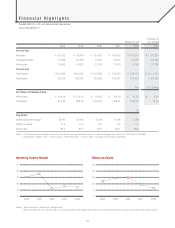

only has the segment grown greatly, but it has achieved a high

operating income margin of 26.7% in the fiscal year under

review. However, a key issue for the Mobile Phone Content

segment is its over-dependence on the Japanese market. In

developing overseas markets, we will not rely excessively on

independent ventures, but work with strong partners in each

region to accelerate business development.

In the Publication segment, sales recorded a CAGR of

11.7%, moving from ¥6.4 billion to ¥11.2 billion over the five-

year period. The operating income ratio stood at 32.5% in the

fiscal year ended March 31, 2008. This rate of sales growth and

profit margin are both exceptional when viewed within Japan’s

publishing industry.

Our cross-media strategy involving magazines, anime, and

comics is producing effective results. However, our unrivaled

strength lies in the harmonious teamwork between authors and

our editorial staff, as well as our business stance emphasizing

early-stage investment in prospective talent and content.

Thanks to these strengths, we have produced a constant

stream of hit titles each year in this unpredictable business,

leading to a very healthy pattern of business development.

The Others segment comprises the sum of our

merchandising business and the arcade game machine

business of SQUARE ENIX (excluding TAITO). Sales have risen

from ¥4.2 billion to ¥9.0 billion over five years, resulting in a

CAGR of 16.4%, while exhibiting a robust operating income

margin of 36.9% in the fiscal year ended March 31, 2008. The

merchandising business has provided steady growth, and we

have also made a sound start in the development of overseas

businesses, so we anticipate significant progress in the near

future. In the fiscal year under review, arcade game machines,

including “DRAGON QUEST Monster Battleroad,” made a

significant contribution to sales. By bringing TAITO into the

Group, we have been able to utilize SQUARE ENIX’s renowned

game development capabilities to bolster the arcade game

business, thus reaping valuable synergies.

The Amusement segment is comprised of all the former

TAITO Group businesses to date. As TAITO was integrated into

the Group in September 2005, it falls outside the calculations

covering our business portfolio at the time SQUARE ENIX was

formed. Consequently the whole of sales in this segment, ¥69.1

billion in the fiscal year ended March 31, 2008, contribute to

growth in sales of the Group. Substantial improvement in profits

by the Amusement segment is of particular note. In the fiscal

year ended March 31, 2006, the initial year in which TAITO

joined the Group, the segment recorded an operating loss of

¥0.7 billion (before amortization of goodwill). However, by the

fiscal year ended March 31, 2007, we had turned this around,

achieving an operating income of ¥1.0 billion (ditto). In the fiscal

year under review, operating income reached ¥4.4 billion (ditto).

Seizing on this momentum, we plan to expand this segment to

a level of ¥10 billion.

As can be seen from this summary, over the past five

years all businesses outside of Games (Offline) have performed

to a respectable level, although there are still a number of

outstanding issues to be dealt with. Next, I will take a closer

look at the challenges we are facing in the Games (Offline)

segment and outline some of the key strategies we have

formulated to deal with these issues.

Challenges in the Games (Offline) Business

The game software we create is primarily centered on role-

playing games (RPGs), and one of the features of our products

is our unrelenting pursuit of the highest possible quality

standards. This quality-focused culture is something in which

we take great pride, and we intend to maintain this approach.

Contrarily, if this focus on quality becomes too extreme, it can

turn into a form of stubbornness, which can sometimes lead to

situations where an organization becomes unable to respond

appropriately to changes in its operating environment. Our track

record shows that we have created works of unrivaled quality

by specializing in the development of games for the leading

game console of the time, thus enabling us to fully capitalize

04