Square Enix 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

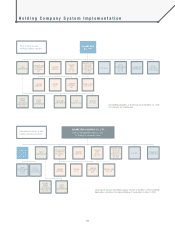

The Company has adopted the corporate auditor system for its corporate

governance. To strengthen monitoring functions and ensure the

maintenance of sound management, at least half of the corporate auditors

are drawn from outside the Company. Furthermore, in accordance with

the objective standards provided under the Company’s internal decision-

making authority rules, the Board of Directors, which sets management

policy, is clearly separated from the decision-making bodies responsible

for the execution of operations. This system aims to enhance the efficiency

and balance of management decision-making and operational execution.

(1) Management control structure and other corporate governance

systems relating to management decision-making, execution of

operations and audit functions

The Board of Directors comprises five directors, including one outside

director. The Company has four corporate auditors, all of whom are drawn

from outside the Company. There is one standing corporate auditor. The

directors are appointed for a term of one year, the same as for companies

adopting the committee system.

The Auditing Division reports directly to the president as an

autonomous internal unit currently comprising two members. The Auditing

Division performs regular monitoring and evaluation of internal control

systems, including those of Group companies, taking into account the

relative importance and risk inherent in each part of the organization, and

provides reports and recommendations to the president. The Auditing

Division’s functions are carried out while sharing information with the

Board of Auditors and the independent audit firm.

To ensure a rigorous compliance system, the Company clearly

specifies the importance of compliance in its management guidelines and

The Square Enix Group Code of Conduct. The Company has established

the Internal Control Committee and an internal compliance reporting

(whistleblower) system, through which Companywide compliance

measures are integrated laterally across organizational reporting lines. With

regard to the management and operation of the Company’s information

systems, which form the foundation of efficient operational functions, the

Company has established the Information System Management

Committee to oversee information systems on a companywide basis.

In principle, the Board of Directors convenes monthly, and each of the

directors, including one outside director, engages in vigorous discussion

and exchange of opinions aimed at enhancing their mutual oversight

functions.

In principle, the Board of Auditors convenes monthly, and conducts

accounting and operational audits based on the audit plan. The corporate

auditors attend meetings of the Board of Directors to audit the execution

of duties of the directors.

With regard to the use of independent outside professionals, the

Company consults with several outside legal counsels as necessary on

significant transactions and legal matters. The Company retains Ernst &

Young ShinNihon as its statutory audit firm under the Companies Act and

the Financial Instruments and Exchange Law to perform independent

third-party accounting audits. The Company fully cooperates with the

statutory audit firm to ensure smooth performance of their duties.

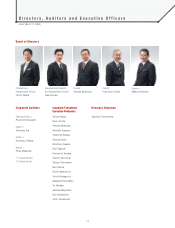

The following certified public accountants (CPAs) conducted audits of

the Company during fiscal 2007.

• CPAs performing audits:

Partners: Koichiro Watanabe, Kenichi Shibata, Tatsuya Yokouchi

• Personnel providing audit assistance:

8 CPAs and 15 assistant CPAs

Remuneration to directors and corporate auditors

Remuneration paid to directors totaled ¥243 million, of which ¥7 million

was paid to the outside director.

Remuneration paid to corporate auditors totaled ¥30 million, of which ¥30

million was paid to outside auditors.

Compensation to independent audit firm

Compensation paid to Ernst & Young ShinNihon for contracted services

prescribed under Article 2, Paragraph 1, of the Certified Public

Accountants Law amounted to ¥57 million.

(2) Personal, financial business or other relationships constituting

conflicts of interest between the Company and its outside

director or outside corporate auditors

There are no such relationships to be specified.

(3) Basic policy on the establishment of internal control systems

The Board of Directors has passed a resolution establishing the

Company’s Basic Policy on Building an Internal Control System. The

Company is building such systems to ensure auditing and supervisory

functions are strictly maintained and to confirm that all business activities

comply with all relevant laws and regulations and the Company’s Articles

of Incorporation, as well as to enhance the efficiency of the directors’

exercise of duties.

(4) Overview of liability limitation agreements

The Company has liability limitation agreements in place with its outside

director and outside corporate auditors in accordance with Article 427,

Paragraph 1, of the Companies Act to limit liabilities provided under Article

423, Paragraph 1, of the Companies Act. These agreements limit the

liability of the outside director and each outside corporate auditor to ¥10

million or the legally specified amount, whichever is greater, on condition

that the director or corporate auditors have performed their duties in good

faith and without gross negligence.

(5) Prescribed number of directors

The Company’s Articles of Incorporation stipulate that the number of

directors shall not exceed 12.

(6) Resolution requirements for the election of directors

The Company’s Articles of Incorporation stipulate that resolutions for the

election of directors shall be made by the majority of votes of shareholders

exercising their voting rights at the General Meeting of Shareholders

where shareholders in attendance hold one-third or more of outstanding

voting rights.

(7) Bodies able to determine dividends paid from retained earnings

The Company’s Articles of Incorporation stipulate that matters provided

under Article 459, Paragraph 1, of the Companies Act may be determined

by the Board of Directors unless legally stipulated otherwise. The objective

of this provision is to expand the range of options enabling flexible

execution of capital policies.

(8) Exemption from liability of directors and corporate auditors

Pursuant to Article 426, Paragraph 1, of the Companies Act, the

Company’s Articles of Incorporation stipulate that a director (including

former directors) may be exempted from liability for actions related to

Article 423, Paragraph 1, of the Companies Act, up to the limit provided

by law, through a resolution passed by the Board of Directors. This

provision aims to ensure the maintenance of an environment in which

directors may exercise their duties to the maximum of their abilities and

are able to fulfill the roles expected of them.

(9) Matters requiring special resolutions at the General Meeting of

Shareholders

The Company’s Articles of Incorporation stipulate that the special

resolutions provided under Article 309, Paragraph 2, of the Companies

Act may be passed by a majority of two-thirds or more of the votes of

shareholders present at the General Meeting of Shareholders where

shareholders in attendance hold one-third or more of outstanding voting

rights. The objective of this relaxation of special resolution requirements is

to ensure the smooth proceedings of the General Meeting of

Shareholders.

1. Basic Stance on Corporate Governance

2. Status of Implementation of Corporate Governance Policies

Corporate Governance

13