Square Enix 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

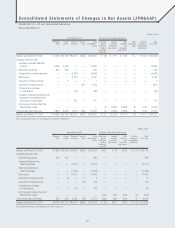

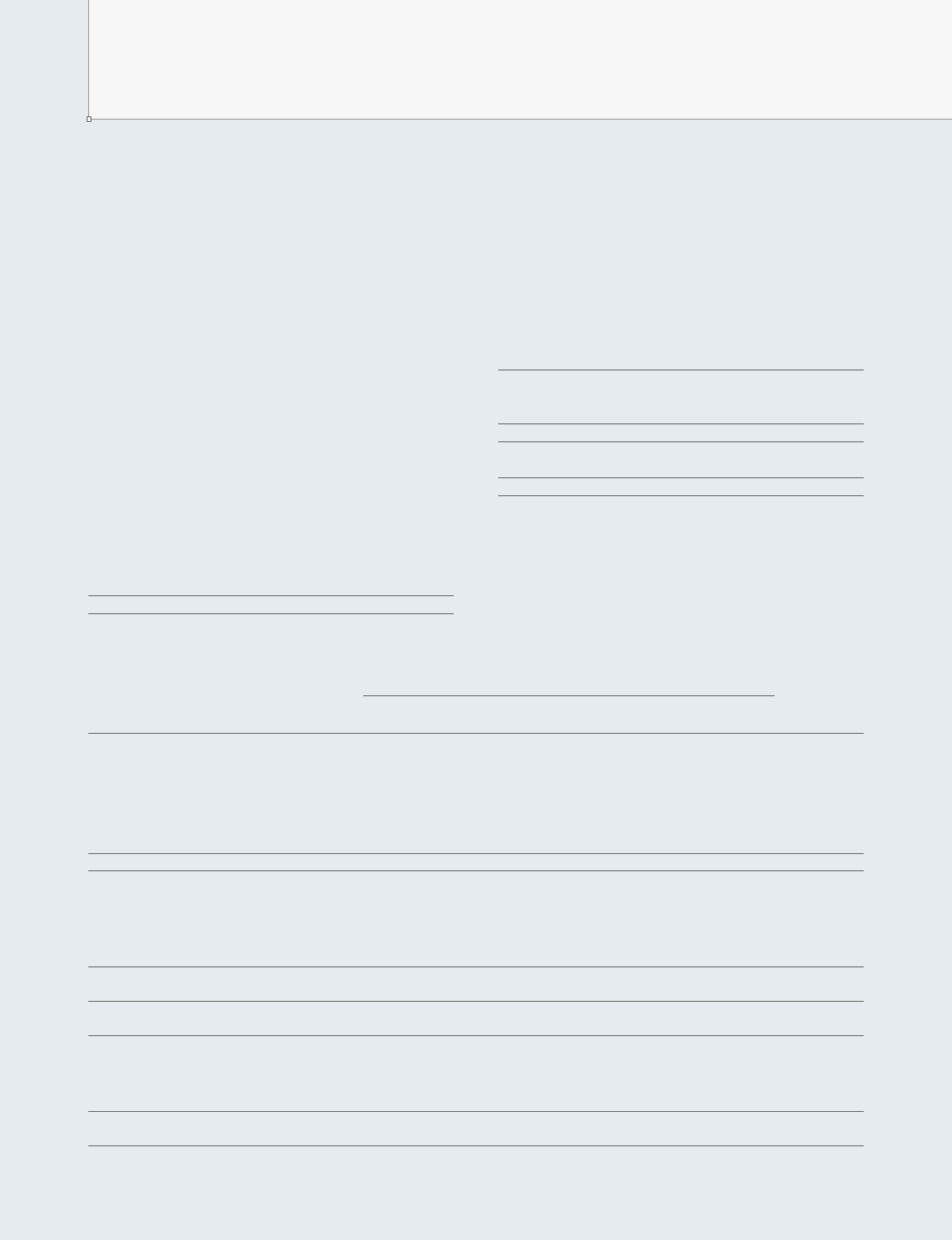

Items Pertaining to the Consolidated Statements of Changes

in Net Assets

• FY2006 (April 1, 2006 to March 31, 2007)

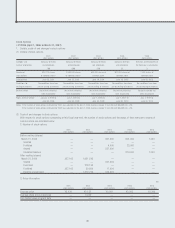

1. Type and number of shares issued and outstanding, and type

and number of shares of treasury stock

Thousands of shares

Shares at Share Share Shares at

the end of increases decreases the end of

FY2005 during the Year during the Year FY2006

Shares issued and

outstanding

Common stock*1 110,729 218 — 110,947

Total 110,729 218 — 110,947

Treasury stock*2

Common stock 182 12 0 193

Total 182 12 0 193

*1 The increase of 218 thousand shares of common stock issued and outstanding

was due to the exercise of stock options.

*2 The increase of 12 thousand shares of treasury stock was due to the acquisition

of fractional shares constituting less than one trading unit.

The decrease of 0 thousand shares of treasury stock was due to the sale of

fractional shares constituting less than one trading unit.

2. Stock options and the Company’s stock options

Number of shares allocated for the purpose of stock options

Details of stock Type of shares issuable Balance at

Category options for the exercise of End of Increase during Decrease during End of the end of FY2006

stock options FY2005 FY2006 FY2006 FY2006 (Millions of yen)

Issuance of yen-

denominated zero-

coupon warrant bonds Common 9,803,921 4,901,961 — 14,705,882 —

Supplying company maturing in 2010, stock

(parent company) pursuant to a resolution of

the Board of Directors

on November 9, 2005

Total — 9,803,921 4,901,961 — 14,705,882 —

Note: The increase of 4,901,961 shares during the year was due to conversion price adjustment conditions being applied to warrant bonds in accordance with the debenture indenture.

3. Dividends

(1) Dividend payments

Total dividends Dividends per share

Date of approval Type of shares (Millions of yen) (Yen) Record date Effective date

June 24, 2006

(Annual General Meeting of Shareholders) Common stock ¥2,210 ¥20 March 31, 2006 June 26, 2006

November 17, 2006

(Board of Directors’ Meeting) Common stock 1,150 10 September 30, 2006 December 8, 2006

(2) Dividends with a record date during this fiscal year, but whose effective date falls in the following fiscal year

Total dividends Dividends per share

Date of approval Type of shares (Millions of yen) Source of dividends (Yen) Record date Effective date

June 23, 2006

(Annual General Meeting of Shareholders) Common stock ¥2,768 Retained earnings ¥25 March 31, 2007 June 25, 2007

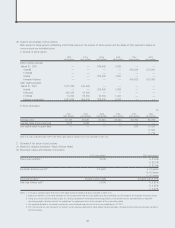

Cash inflows from business segments of the Group are complemen-

tary to one another in terms of similarities in the nature of products,

merchandise, services and markets. Consequently, all assets for

operational purposes are classified in one asset group, and idle

assets which are not used for operational purposes are classified

individually. In addition, assets related to the Group’s headquarters

and welfare facilities are classified as common-use assets.

Telephone subscription rights in the above table were idle

assets and their market value fell substantially below their respec-

tive book value. Since they were not expected to be used in the

future, they were marked down to their respective recoverable value,

resulting in an impairment loss of ¥9 million, which was posted as

an extraordinary loss.

In principle, the recoverable amounts for these assets are

determined based on their respective fair value calculated using

market prices.

*6 A breakdown of loss on disposal and write-downs of assets

associated with business restructuring is as follows:

Inventories ¥ 658 million

Current assets 249 million

Other 394 million

Total ¥1,302 million

34