Square Enix 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

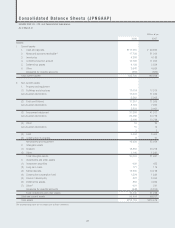

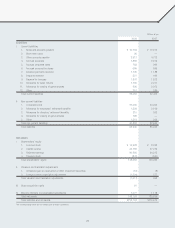

Content Production Account

Millions of yen

March 31 2007 2008 Change

¥11,903 ¥14,793 ¥2,890

As a rule, content development costs incurred during the period

from a title’s formal development authorization through to its

release are capitalized in the content production account. When the

title is released, this amount is then recorded as an expense.

The content production account is reevaluated based on the

current business environment. In the event that a title development

project is canceled as a result of such reevaluation, the Company

may write-off capitalized development costs for the canceled title in

the content production account as an extraordinary loss. Costs

incurred during the pre-production phase—the phase before devel-

opment is formally approved—are posted as selling, general and

administrative (SG&A) expenses as they are incurred.

As of March 31, 2008, the content production account totaled

¥14,793 million, an increase of ¥2,890 million compared with the

end of the prior fiscal year.

Deferred Tax Assets

Millions of yen

March 31 2007 2008 Change

Current ¥5,634 ¥4,158 ¥(1,476)

Non-current 4,939 852 (4,087)

In September 2005, the Company acquired 93.7% of the common

shares of TAITO CORPORATION via a takeover bid. Subsequently,

TAITO CORPORATION was merged with SQEX, Inc., a wholly-owned

subsidiary of the Company, resulting in TAITO CORPORATION

becoming part of a wholly-owned subsidiary of the Company.

The temporary tax differences associated with the takeover of

TAITO CORPORATION were recognized as a tax effect that the

Company is expected to recover in the future, and the expected

amount to be recovered was recorded as a deferred tax asset.

Current deferred tax assets as of March 31, 2008, amounted to

¥4,158 million, a decrease of ¥1,476 million, and non-current tax

assets totaled ¥852 million, a decrease of ¥4,087 million.

Property and Equipment

Millions of yen

March 31 2007 2008 Change

¥25,664 ¥19,939 ¥(5,725)

Net property and equipment decreased ¥5,725 million to ¥19,939

million, primarily owing to a decrease in amusement equipment from

¥10,798 million to ¥5,906 million. This was mainly due to a changeover

to leasing contracts when introducing new amusement equipment.

3. Analysis of Business Performance in Fiscal 2007

(Ended March 31, 2008)

Assets

Total Assets

Millions of yen

March 31 2007 2008 Change

¥215,679 ¥212,134 ¥(3,544)

Total assets as of March 31, 2008 amounted to ¥212,134 million, a

decrease of ¥3,544 million compared with the previous fiscal year

end. The main factors contributing to this change were as follows:

Cash and Deposits

Millions of yen

March 31 2007 2008 Change

¥99,852 ¥111,515 ¥11,663

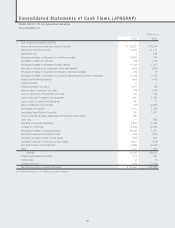

Cash flows in fiscal 2007, as well as the principal factors behind

these cash flows, are described below.

(1) Net cash provided by operating activities

Net cash provided by operating activities amounted to ¥23,655 million.

In addition to income before income taxes and minority interests of

¥16,681 million, there was a decrease in allowance for doubtful

accounts, a decrease in accounts receivable and a decrease in

accounts payable.

(2) Net cash used in investing activities

Net cash used in investing activities totaled ¥5,805 million. The

main item within this was payments for acquiring property and

equipment of ¥6,597 million.

(3) Net cash used in financing activities

Net cash used in financing activities amounted to ¥3,404 million.

The largest item within this was payments for dividends of

¥3,882 million.

Notes and Accounts Receivable

Millions of yen

March 31 2007 2008 Change

¥21,206 ¥17,738 ¥(3,468)

The year end balance of notes and accounts receivable varies

greatly depending on the timing of new game title releases. Notes

and accounts receivable at year end were ¥17,738 million, a

decrease of ¥3,468 million compared with the previous year end.

17