Square Enix 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Significant Subsequent Events

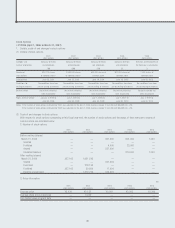

• FY2006 (April 1, 2006 to March 31, 2007)

Granting of Stock Options

At the 27th Annual General Meeting of Shareholders, convened

on June 23, 2007, a resolution was passed to grant stock

acquisition rights to directors as a part of their remuneration in

accordance with Articles 236 and 238 of Corporation Law.

The details are outlined below.

(1) Reason for issuing stock acquisition rights to directors

The objectives of issuing stock acquisition rights as stock

options are to provide an incentive to the Company’s directors

in consideration of the execution of their duties, to improve

operating performance and corporate value and to heighten

their managerial awareness from a shareholder’s perspective.

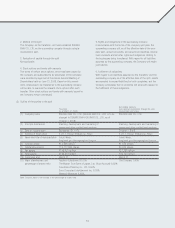

(2) Overview of stock options

1. Recipients of stock acquisition rights allocation

Directors of the Company

2. Type and number of shares reserved for the purpose of stock

acquisition rights

A maximum of 450,000 shares of common stock in a one-

year period. In the event that the Company conducts a stock

split or a reverse stock split, the Company shall adjust this

number in the manner it deems fit.

3. Amount payable upon delivery of stock acquisition rights

No cash need be paid in exchange for these stock acquisition

rights.

4. Value of assets subscribed upon exercise of each stock acquisi-

tion right

The value of assets subscribed upon exercise of stock acqui-

sition rights shall be the per-share payment that may be paid

upon accepting delivery (hereinafter, “the Exercise Price”) multi-

plied by the number of shares granted that corresponds to these

stock acquisition rights.

The Exercise Price shall be the average of the closing price

on the Tokyo Stock Exchange during the six-month period pre-

ceding the month in which the allocation date falls (an excep-

tion applies in the event trading is not conducted on that day),

multiplied by 1.05 with amounts less than one yen truncated. If

the Exercise Price is less than the closing price of the day pre-

ceding the allocation date, the closing price of the day preced-

ing the allocation date shall be used. (If the closing price is not

available on the day preceding the allocation date, the most

recent closing price shall be used.)

In the event the Company carries out a stock split or a reverse

stock split and a revaluation of the Company’s shares of common

stock become nesessary, the Company may apply any appropriate

measures it deems necessary to justify the price per share.

No cash need be paid in exchange for these stock options.

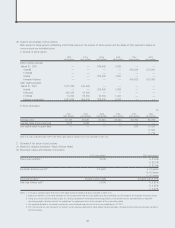

• FY2007 (April 1, 2007 to March 31, 2008)

Implementation of a Pure Holding Company Structure by Means of a

Company Split

On May 23, 2008, a meeting of the Board of Directors approved a

resolution under which the Company will move to a pure holding

company structure by means of an incorporation-type company split

effective October 1, 2008. Under this plan, a newly established

wholly-owned subsidiary will assume the operations of the

Company’s business effective October 1, 2008. Accompanying this

move to a holding company structure, effective October 1, 2008, the

Company’s Articles of Incorporation will be partially revised and the

company’s name is planned to be changed to SQUARE ENIX

HOLDINGS CO., LTD. The Board of Directors’ resolution referred to

above also determined that the Company’s purpose will be changed

to that of a pure holding company. The Company plans to maintain

the listing of its stock on the First Section of the Tokyo Stock

Exchange as a holding company.

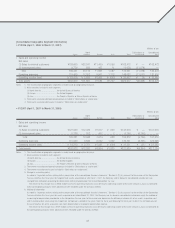

(1) Purpose of the company split

The Company believes that it is crucial to maintain profitability and

achieve medium- to long-term growth through the provision of high-

quality, sophisticated content and services. However, in recent

years, as information technology (IT) and telecommunications tech-

nology and infrastructure have rapidly developed and seen wide-

spread adoption, customer preferences have become greatly

diversified and the speed of technical innovation has accelerated. In

such a business environment, the Company has determined to pur-

sue a strategy of moving to a pure holding company structure. As

well as aiming to clarify the profitability of each business and the

accountability structure, this move is seen as crucial to facilitating

Group management that can flexibly engage in strategic business

alliances, including capital alliances with other companies.

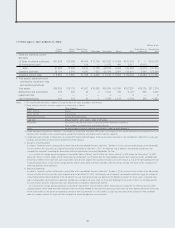

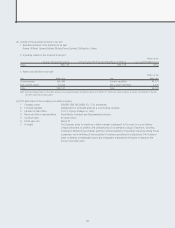

(2) Outline of the company split

1. Schedule for the split

Record date for the Ordinary General Meeting of Shareholders

March 31, 2008

Meeting of the Board of Directors to pass a resolution for the

move to a pure holding company structure

April 25, 2008

Meeting of the Board of Directors to pass a resolution for

implementation of the company split

May 23, 2008

Annual General Meeting of Shareholders in which a resolution

for the company split is to be approved

June 21, 2008

Effective date of the company split

October 1, 2008 (scheduled)

50