Square Enix 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group provides online game services and sells software discs for

online games.

In the fiscal year under review, sales in Europe amounted to

¥7,896 million, a decrease of ¥4,375 million, which was mainly

attributable to the absence of any major game title releases during

the period.

Asia

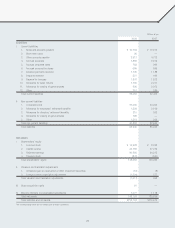

Millions of yen

Years ended March 31 2007 2008 Change

¥1,551 ¥1,118 ¥(433)

In Asia, the Group primarily is engaged in the Games (Online) and

Amusement businesses. In the Games (Online) business, the Group

primarily operates online game services for the PC platform in

China. In this business in fiscal 2007, the Group commenced a

restructuring of operations in response to changes in the market

environment. The Group will continue to pursue business opportuni-

ties in China based on a flexible approach, including tie-ups with

local companies.

In the Amusement business, the Group operates game arcade

facilities in South Korea and China.

Sales in Asia in fiscal 2007 decreased ¥433 million to

¥1,118 million.

4. Strategic Outlook, Issues Facing Management and

Future Direction

Management’s key task is to ensure growth in the Group in the

medium- and long-term, maintaining profitability through the cre-

ation of advanced, high-quality content and services. As the devel-

opment and popularization of information technology (IT) and

network environments rapidly advance, we anticipate a major trans-

formation in the structure of the digital entertainment industry. We

believe that this will be driven by such factors as increased con-

sumer needs in the area of network-compliant entertainment and

growing access to a diverse range of content by users of devices

that provide multiple functions.

The Group will strive to respond to these changes, and has

adopted a medium- to long-term management strategy that focuses

on pioneering a new era in digital entertainment.

The Group’s operating targets for the fiscal year ending March

31, 2009 are as follows (as of May 23, 2008).

Millions of yen

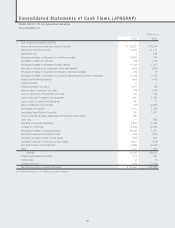

Years ended/ 2004 2005 2006 2007 2008 2009

ending March 31 results results results results results targets

Net sales ¥63,202 ¥73,864 ¥124,473 ¥163,472 ¥147,516 ¥160,000

Operating

income 19,398 26,438 15,470 25,916 21,520 21,000

Recurring

income 18,248 25,901 15,547 26,241 18,864 20,000

Net income 10,993 14,932 17,076 11,619 9,196 12,000

Owing to the consolidation of TAITO at the end of September 2005,

TAITO’s operating results are reflected in the Company’s consoli-

dated statements of income effective October 2005. Following this

merger, we have set an operating income ratio target of at least 20%

and a target for annual average growth in net income per share (EPS)

of at least 10%. These are our two main numerical targets.

5. Dividend Policy

The Group recognizes the return of profits to shareholders as one of

its most important management tasks. The Company maintains

internal reserves to enable priority to be given to investments that

will enhance the value of the Group. Such investments may include

capital investments and M&A for the purpose of expanding existing

businesses and developing new businesses. The retention of internal

reserves is done while also taking into account return to sharehold-

ers, operating performance and the optimal balance for stable divi-

dends. Accordingly, the Company strives to maintain stable and

continuous dividends. The portion of dividends linked to operating

results is determined by setting a consolidated payout ratio target of

approximately 30%.

The Company’s basic policy is to pay dividends from retained

earnings twice a year, through an interim dividend and a year end

dividend. The year end dividend is determined at the Annual General

Meeting of Shareholders, and the interim dividend is determined by

the Board of Directors.

For fiscal 2007, total dividends applicable to the year were ¥30

per share, comprising an interim dividend of ¥10 per share and a

year end dividend of ¥20 per share. The consolidated payout ratio

for fiscal 2007 was 36.7%.

Millions of yen Yen

Date of resolution Total dividends Dividends per share

November 19, 2007

Resolution of the Board of Directors ¥1,115 ¥10

June 21, 2008

Resolution of the Annual General

Meeting of Shareholders 2,296 20

6. Risk Factors

The risks described below are those that could affect the Company’s

business performance. Forward-looking statements in this manage-

ment discussion and analysis are in accordance with management’s

judgments as of June 30, 2008.

(1) Changes in the Economic Environment

In the event of an exceptionally harsh downturn in the economy

causing consumer expenditure to fall, demand for the Group’s

products and services in the entertainment field may decline. Such

circumstances may lead to an adverse impact on the Group’s

business performance.

20