Square Enix 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders

I am grateful to our shareholders for the opportunity to present the Company’s annual report for the fiscal

year ended March 31, 2008.

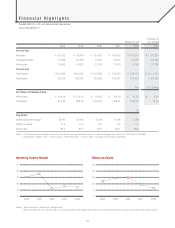

In the fiscal year under review, on a consolidated basis, net sales declined 9.8% to ¥147,516 million.

Operating income decreased 17.0% to ¥21,520 million, and recurring income declined 28.1% to ¥18,864

million. Net income amounted to ¥9,196 million, a 20.9% decrease compared with the previous fiscal year.

As a result, the recurring income margin was 12.8%, and return on equity (ROE) stood at 6.7%.

The Company’s dividend policy is to maintain an optimal balance between performance-linked payouts

and stable returns to shareholders. In line with this policy, we have set dividends for the fiscal year ended

March 31, 2008 at ¥30 per share, resulting in a consolidated payout ratio of 36.7%.

We were unable to surpass the recurring income we achieved in the previous fiscal year.

Five years have now passed since the merger that led to the formation of SQUARE ENIX. After reviewing

the progress made during this period, we intend to refine and reaffirm our strategies for the future.

Fiscal year ended March 31, 2008:

Earnings Remain within Current Range

In April 2003, Square Co., Ltd., and Enix Corporation carried

out a merger in order to be better prepared for the coming

industry reorganization. Since its formation, the Company has

successfully raised recurring income from its previous range

of ¥5–¥18 billion to a new range of ¥15–¥27 billion (see Figure

1 on page 05). The synergies created between Square and

Enix have acted to bolster the earning potential of the merged

Company, and have built a foundation to take us to the next

stage of growth.

We have embarked on an array of initiatives to further

increase the Company’s earning potential to ¥50 billion;

however, we were unfortunately not able to make significant

headway towards this target in the fiscal year ended March

31, 2008.

Results of the Company’s First Five Years:

Nearly All Business Segments on a Growth Track

To shape a basic business structure, management should

first focus on sales growth, while following with a focus on

earnings enhancement. To verify the effectiveness of our

growth strategies, it is worthwhile to look at the compound

annual growth rate (CAGR) of sales for each business

segment. The Games (Offline) segment generated sales of

¥45.7 billion in the fiscal year ended March 31, 2003 (simple

total of the corresponding segment sales of the pre-merged

companies), while in the fiscal year ended March 31, 2008, the

corresponding figure was ¥41.6 billion. With a CAGR of -1.9%,

we can see that this segment has fallen back to its starting

point. This alludes to issues that must be addressed in both

product development and marketing, which I will discuss later.

Meanwhile, all of our other business segments have exhibited

robust growth over this five-year period. The Games (Online)

segment has achieved a 23.8% CAGR, with sales moving

from ¥4.2 billion to ¥12.1 billion. The segment has also built

a good balance among the three key regions of Japan, North

America, and Europe, while exhibiting an extremely strong

operating income margin of 48.6% in the fiscal year ended

March 31, 2008. In a very short time this segment has become

one of our core businesses. At present, the segment’s reliance

on our flagship massively multiplayer online role-playing game

(MMORPG) is considerable; however, we see progress in our

nurturing of different types of products and services, including

casual online games. We are also starting to experiment with

a range of new earnings models, such as per-item-based

charging. These developments have enabled continuous growth

in the Games (Online) segment.

In the Mobile Phone Content segment, we have expanded

sales from ¥1.7 billion to ¥6.6 billion, a CAGR of 31.1%. Not

03