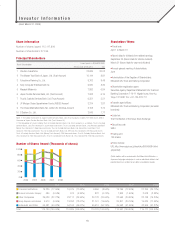

Square Enix 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

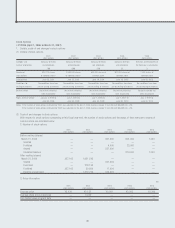

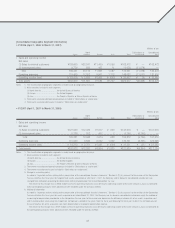

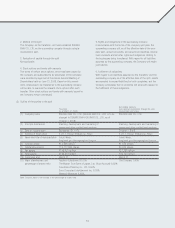

• FY2007 (April 1, 2007 to March 31, 2008)

Millions of yen

Games Games Mobile Phone Eliminations or Consolidated

(Offline) (Online) Content Publication Amusement Others Total unallocated total

I Sales and operating income

Net sales

(1) Sales to external customers ¥41,588 ¥12,098 ¥6,474 ¥11,158 ¥67,632 ¥ 8,564 ¥147,516 ¥ — ¥147,516

(2) Intersegment sales — — 104 — 1,471 440 2,017 (2,017) —

Total 41,588 12,098 6,579 11,158 69,104 9,005 149,533 (2,017) 147,516

Operating expenses 32,705 6,218 4,820 7,532 65,974 5,681 122,931 3,064 125,996

Operating income (loss) ¥ 8,882 ¥ 5,880 ¥1,758 ¥ 3,626 ¥ 3,129 ¥ 3,324 ¥ 26,602 ¥ (5,082) ¥ 21,520

II Total assets, depreciation and

amortization, impairment loss

and capital expenditures

Total assets ¥64,345 ¥18,118 ¥7,697 ¥10,588 ¥68,380 ¥13,266 ¥182,397 ¥29,736 ¥212,134

Depreciation and amortization 375 428 43 5 7,544 730 9,127 805 9,933

Impairment loss — — — — 9 — 9 — 9

Capital expenditures 426 234 10 1 4,768 1,142 6,584 368 6,952

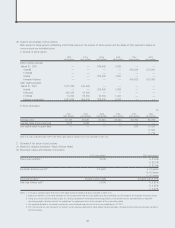

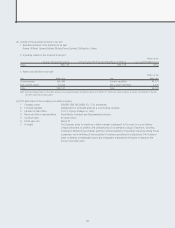

Notes: 1. The classification of business segments is made based on the types of products and services.

2. Major products offered by business segment are summarized as follows:

Segment Major Products

Games (Offline) Games

Games (Online) Online games

Mobile Phone Content Content for mobile phones

Publication Magazine comics, serial comics, game-related books

Amusement All businesses of the Taito Group including Amusement Operations and Rental,

Sales of Goods and Merchandise and Content Services

Others Derivative products such as character merchandise, school for game designers

3. Unallocated operating expenses included in “Eliminations or unallocated” totaled ¥5,082 million. These expenses were related to administrative departments of the

Company which provide services and operational support that cannot be allocated to specific business segments.

4. Unallocated assets included in “Eliminations or unallocated” totaled ¥30,558 million. These assets mainly consisted of cash and deposits, deferred tax assets and

buildings and structures of administrative departments of the Company.

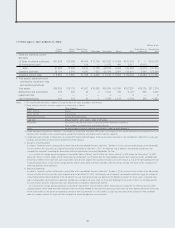

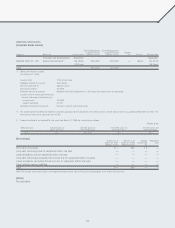

5. Change in accounting policy

As noted in “Important matters relating to the presentation of the consolidated financial statements,” Section 4. (2) (A), pursuant to the revision of the Corporation

Tax Law, effective this fiscal year, for tangible fixed assets acquired on or after April 1, 2007, the Company and its domestic consolidated subsidiaries have

changed their method of accounting for depreciation to that provided under the revised Corporation Tax Law.

As a result of this change, operating expenses increased for “Games (Offline)” by ¥33 million, for “Games (Online)” by ¥13 million, for “Amusement” by ¥537

million, for “Others” by ¥224 million and for “Eliminations or unallocated” by ¥19 million over the corresponding amounts which would have been recorded under

the previous method. At the same time, operating income (loss) for each segment decreased (increased) by the same amount as that of the corresponding increase

in operating expenses as a result of this change from the amount which would have been recorded under the previous method. The impact of this change on the

remaining segments were immaterial.

6. Additional information

As noted in “Important matters relating to the presentation of the consolidated financial statements,” Section 4. (2) (A), pursuant to the revision of the Corporation

Tax Law, effective this fiscal year, for assets acquired on or before March 31, 2007, the Company and its domestic consolidated subsidiaries apply the method of

accounting for depreciation provided for in the Corporation Tax Law prior to the revision and depreciate the difference between 5% of an asset’s acquisition cost

and its memorandum value using the straight-line method over a period of five years, from the fiscal year following the fiscal year in which the net book value of

the asset reaches 5% of its acquisition cost. Such depreciation is recorded in depreciation expense.

As a result of this change, operating expenses increased for “Amusement” by ¥137 million and for “Eliminations or unallocated” by ¥9 million over the corre-

sponding amounts which would have been recorded under the previous method. At the same time, operating income (loss) for each segment decreased (increased)

by the same amount as that of the corresponding increase in operating expenses as a result of this change from the amount which would have been recorded

under the previous method. The impact of this change on the remaining segments were immaterial.

46