Square Enix 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

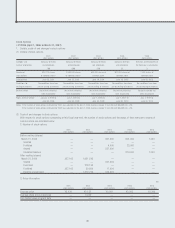

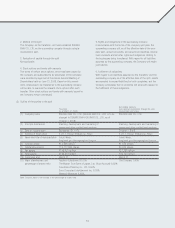

[Consolidated Geographic Segment Information]

• FY2006 (April 1, 2006 to March 31, 2007)

Millions of yen

North Eliminations or Consolidated

Japan America Europe Asia Total unallocated total

I Sales and operating income

Net sales

(1) Sales to external customers ¥128,665 ¥22,341 ¥11,409 ¥1,056 ¥163,472 ¥ — ¥163,472

(2) Intersegment sales 9,776 833 457 11 11,078 (11,078) —

Total 138,441 23,174 11,867 1,067 174,551 (11,078) 163,472

Operating expenses 119,465 17,552 9,901 1,713 148,633 (11,077) 137,555

Operating income (loss) ¥ 18,976 ¥ 5,621 ¥1,965 ¥ (645) ¥ 25,917 ¥ (0) ¥ 25,916

II Total assets ¥203,303 ¥11,881 ¥7,585 ¥2,747 ¥225,517 ¥(9,838) ¥215,679

Notes: 1. The classification of geographic segments is made based on geographical distance.

2. Main countries included in each segment:

(1) North America .......................... the United States of America

(2) Europe .................................... the United Kingdom

(3) Asia........................................ the People’s Republic of China, Republic of Korea

3. There were no unallocated operating expenses included in “Eliminations or unallocated.”

4. There were no unallocated assets included in “Eliminations or unallocated.”

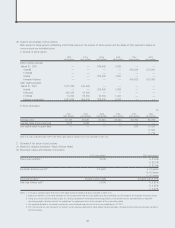

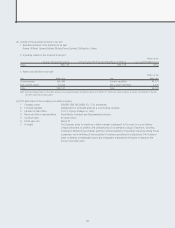

• FY2007 (April 1, 2007 to March 31, 2008)

Millions of yen

North Eliminations or Consolidated

Japan America Europe Asia Total unallocated total

I Sales and operating income

Net sales

(1) Sales to external customers ¥127,643 ¥12,035 ¥7,217 ¥ 620 ¥147,516 ¥ — ¥147,516

(2) Intersegment sales 5,738 552 457 7 6,756 (6,756) —

Total 133,381 12,588 7,674 628 154,273 (6,756) 147,516

Operating expenses 115,069 9,836 6,592 1,222 132,721 (6,725) 125,996

Operating income (loss) ¥ 18,312 ¥ 2,751 ¥1,081 ¥ (594) ¥ 21,551 ¥ (31) ¥ 21,520

II Total assets ¥202,922 ¥12,387 ¥4,804 ¥1,825 ¥221,939 ¥(9,804) ¥212,134

Notes: 1. The classification of geographic segments is made based on geographical distance.

2. Main countries included in each segment:

(1) North America .......................... the United States of America

(2) Europe .................................... the United Kingdom

(3) Asia........................................ the People’s Republic of China, Republic of Korea

3. There were no unallocated operating expenses included in “Eliminations or unallocated.”

4. There were no unallocated assets included in “Eliminations or unallocated.”

5. Change in accounting policy

As noted in “Important matters relating to the presentation of the consolidated financial statements,” Section 4. (2) (A), pursuant to the revision of the Corporation

Tax Law, effective this fiscal year, for tangible fixed assets acquired on or after April 1, 2007, the Company and its domestic consolidated subsidiaries have

changed their method of accounting for depreciation to that provided under the revised Corporation Tax Law.

The impact of this change was an ¥828 million increase in operating expenses and a decrease in operating income of the same amount in Japan as compared

to the corresponding amounts which would have been recorded under the previous method.

6. Additional information

As noted in “Important matters relating to the presentation of the consolidated financial statements,” Section 4. (2) (A), pursuant to the revision of the Corporation

Tax Law, effective this fiscal year, for assets acquired on or before March 31, 2007, the Company and its domestic consolidated subsidiaries apply the method of

accounting for depreciation provided for in the Corporation Tax Law prior to the revision and depreciate the difference between 5% of an asset’s acquisition cost

and its memorandum value using the straight-line method over a period of five years, from the fiscal year following the fiscal year in which the net book value of

the asset reaches 5% of its acquisition cost. Such depreciation is recorded in depreciation expense.

The impact of this change was a ¥149 million increase in operating expenses and a decrease in operating income of the same amount in Japan as compared to

the corresponding amounts which would have been recorded under the previous method.

47