Square Enix 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

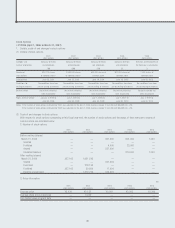

5. Valuation of Assets and Liabilities of Consolidated

Subsidiaries

• FY2006 (April 1, 2006 to March 31, 2007)

All assets and liabilities of consolidated subsidiaries are revalued on

acquisition.

• FY2007 (April 1, 2007 to March 31, 2008)

Same as in FY2006

6. Amortization of goodwill

• FY2006 (April 1, 2006 to March 31, 2007)

Goodwill is amortized using the straight-line method over a period of

either five years or 20 years. However, goodwill whose value has

been extinguished is fully amortized during the fiscal year in which

it was incurred.

• FY2007 (April 1, 2007 to March 31, 2008)

Same as in FY2006

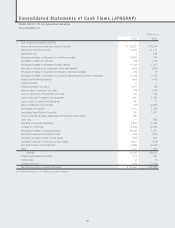

7. Scope of Cash and Cash Equivalents in the Consolidated

Statements of Cash Flows

• FY2006 (April 1, 2006 to March 31, 2007)

Cash and cash equivalents in the consolidated statements of cash

flows are comprised of cash on hand, bank deposits which are able

to be withdrawn on demand and highly liquid short-term invest-

ments with an original maturity of three months or less and with

minor risk of significant fluctuations in value.

• FY2007 (April 1, 2007 to March 31, 2008)

Same as in FY2006

New Accounting Standards

• FY2006 (April 1, 2006 to March 31, 2007)

(Accounting Standard for Presentation of Net Assets in the

Balance Sheet)

“Accounting Standard for Presentation of Net Assets in the Balance

Sheet” (Accounting Standards Board of Japan Statement No. 5,

December 9, 2005) and “Guidance on Accounting Standard for

Presentation of Net Assets in the Balance Sheet” (Accounting

Standards Board of Japan Guidance No. 8, December 9, 2005) were

adopted effective the fiscal year ended March 31, 2007. The amount

corresponding to total shareholders’ equity under the previous

method of presentation was ¥129,461 million.

The net assets section of the consolidated balance sheet was

prepared in accordance with the revised “Regulations for

Consolidated Financial Statements.”

(Accounting Standards for Business Combinations)

Effective the fiscal year ended March 31, 2007, the Company

adopted “Accounting Standard for Business Combinations”

(Business Accounting Council, October 31, 2003), “Accounting

Standard for Business Divestitures” (Accounting Standards Board of

Japan Statement No. 7, December 27, 2005) and “Implementation

Guidance on Accounting Standard for Business Combinations and

Accounting Standard for Business Divestitures” (Accounting

Standards Board of Japan Guidance No. 10, December 27, 2005).

• FY2007 (April 1, 2007 to March 31, 2008)

Not applicable

Reclassifications

• FY2006 (April 1, 2006 to March 31, 2007)

(Consolidated Balance Sheets)

In accordance with revisions made in the regulations for the consoli-

dated balance sheet, the consolidation adjustment account and the

“goodwill” portion of the “other” item within intangible assets at

March 31, 2006 were reclassified into “goodwill” effective the fiscal

year ended March 31, 2007. In the consolidated balance sheet at

March 31, 2006, the “goodwill” portion of the “other” item within

intangible fixed assets amounted to ¥218 million.

(Consolidated Statements of Cash Flows)

Within cash flows from operating activities, for the fiscal year ended

March 31, 2006, foreign exchange gains and losses were recorded

in the “other” category of cash flows from operating activities. This

has been listed as a separate accounting category effective the

fiscal year ended March 31, 2007.

The amount within the “other” category corresponding to foreign

exchange gains and losses for the fiscal year ended March 31,

2006 was ¥(223) million.

For the fiscal year ended March 31, 2006, goodwill amortiza-

tion was included within the “other” segment in cash flows from

operating activities. This has been listed as a separate accounting

category effective the fiscal year ended March 31, 2007.

Amortization of the consolidated adjustment account, included

in the “other” category for the fiscal year ended March 31, 2006,

was ¥1,445 million.

• FY2007 (April 1, 2007 to March 31, 2008)

Not applicable

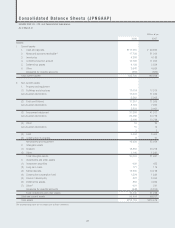

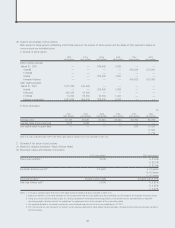

Notes to Consolidated Balance Sheets

• FY2006 (April 1, 2006 to March 31, 2007)

*1 Investments in non-consolidated subsidiaries and affiliates:

Investments and other assets ¥119 million

*2 Contingent liabilities for guarantees:

The Company’s consolidated subsidiary, TAITO CORPORATION,

has issued a guarantee of ¥12 million covering its lease obligations

to Diamond Asset Finance Co., Ltd., one of the Company’s sales

partners.

32