Square Enix 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• FY2007 (April 1, 2007 to March 31, 2008)

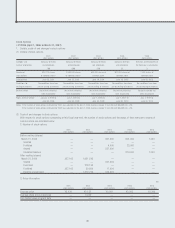

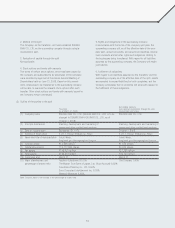

1. Significant components of deferred tax assets and liabilities are

summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise taxes payable ¥ 79

Business office tax payable 55

Reserve for bonuses 731

Advances paid 36

Accrued expenses 361

Allowance for sales returns 199

Non-deductible portion of allowance for

doubtful accounts 239

Tax credit 294

Loss on write-offs of content production account 1,884

Loss carried forward 1,639

Loss on inventory revaluation 123

Loss on disposal of assets associated with

business restructuring 347

Other 130

Valuation allowance (1,485)

Offset to deferred tax liabilities (current) (480)

Total 4,158

2) Non-current assets

Non-deductible portion of allowance for

employees’ retirement benefits 1,086

Allowance for directors’ retirement benefits 77

Non-deductible depreciation expense of property

and equipment 537

Loss on investments in securities 379

Non-deductible portion of allowance for

doubtful accounts 780

Tax effect from sale of stock of

affiliated companies 1,965

Allowance for closing of game arcades 413

Loss carried forward 4,816

Other 179

Valuation allowance (9,382)

Total 852

Net deferred tax assets 5,010

Deferred tax liabilities

Current liabilities

Accrued expenses and other cost calculation details 480

Offset to deferred tax assets (non-current assets) (480)

Total —

Total deferred tax liabilities —

Balance: Net deferred tax assets ¥5,010

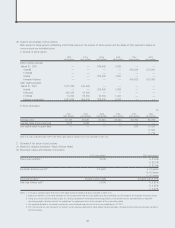

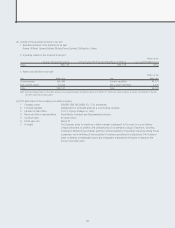

2. A reconciliation of the statutory tax rate and the effective tax

rate is as follows:

Statutory tax rate 40.70%

Permanent differences relating to entertainment

expenses, etc., excluded from non-taxable expenses 0.47

Permanent differences relating to

dividends received, etc., excluded from

non-taxable expenses (0.01)

Taxation on a per capita basis for inhabitants’ taxes 0.38

Deduction for foreign taxes paid 1.82

Amortization of goodwill 3.33

Valuation allowance (5.87)

Tax effect from sale of stock of affiliated companies 5.03

Adjustments for unrecognized losses (0.03)

Differences in tax rates from

the parent company’s statutory tax rate (1.35)

Other 0.84

Effective tax rate 45.31%

44