Square Enix 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

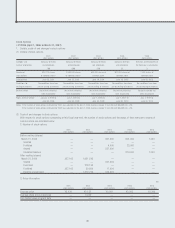

Retirement Benefits

• FY2006 (April 1, 2006 to March 31, 2007)

1. Overview of retirement benefit plan

The Company and its domestic consolidated subsid iaries have

a lump-sum retirement payment plan in accordance with their

internal bylaws.

The projected benefits are allocated to periods of service on

a straight-line basis. The Company’s domestic consolidated

subsidiaries apply a simplified method in the calculation of the

retirement benefit obligations. In addition, certain of the

Company’s overseas subsidiaries maintain defined contribution

retirement pension plans.

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥(10,612)

Fair value of plan assets 9,871

Net unfunded obligation (741)

Unrecognized prior service cost (1,138)

Unrecognized actuarial gain (289)

Allowance for retirement benefits ¥ (2,169)

3. Retirement benefit expenses:

Millions of yen

Service cost ¥600

Interest cost 172

Expected return on plan assets (170)

Amortization of prior service cost (406)

Amortization of net actuarial loss 190

Retirement benefit expenses ¥386

Note: Due to the restructuring of certain businesses, such as the amusement busi-

ness, in the fiscal year ended March 31, 2007, a substantial number of

employees retired, and the Company recognized a curtailment of its retire-

ment benefit plan in accordance with “Accounting for Transfers between

Retirement Benefit Schemes” (Application Guideline No. 1 of Business

Accounting Principles). As a result, the Company recognized a partial

reversal of allowance for employees’ retirement benefits and a lump-sum

amortization of unrecognized gain/loss amounting to ¥465 million as an

extraordinary gain, which was included in the amortization of prior service

cost and amortization of net actuarial gains and losses in the fiscal year

ended March 31, 2007.

In addition to the above, the Company recorded an extraordinary loss for

premium severance payments of ¥925 million.

4. Assumptions used in accounting for the above plans:

Periodic allocation method for projected benefits Straight-line basis

Discount rates 1.700%–2.093%

Expected rate of return on plan assets 1.700%

Period over which prior service cost is amortized 1–5 years

Period over which net actuarial gain or loss

is amortized 1–5 years

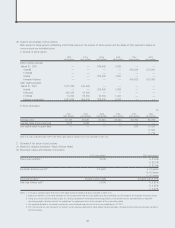

• FY2007 (April 1, 2007 to March 31, 2008)

1. Overview of retirement benefit plan

The Company and its domestic consolidated subsid iaries have a

lump-sum retirement payment plan in accordance with their

internal bylaws.

The projected benefits are allocated to periods of service on

a straight-line basis. The Company’s domestic consolidated

subsidiaries apply a simplified method in the calculation of the

retirement benefit obligations. In addition, certain of the

Company’s overseas subsidiaries maintain defined contribution

retirement pension plans.

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥(11,343)

Fair value of plan assets 8,830

Net unfunded obligation (2,513)

Unrecognized prior service cost (805)

Unrecognized actuarial loss 1,790

Allowance for retirement benefits ¥ (1,528)

3. Retirement benefit expenses:

Millions of yen

Service cost ¥ 509

Interest cost 180

Expected return on plan assets (158)

Amortization of prior service cost (333)

Amortization of net actuarial gain (201)

Retirement benefit expenses ¥ (3)

4. Assumptions used in accounting for the above plans:

Periodic allocation method for projected benefits Straight-line basis

Discount rates 1.700–2.026%

Expected rate of return on plan assets 1.700%

Period over which prior service cost is amortized 1–5 years

Period over which net actuarial gain or loss

is amortized 1–5 years

39