SkyWest Airlines 2002 Annual Report Download - page 51

Download and view the complete annual report

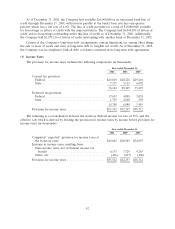

Please find page 51 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from Delta and Delta provides certain services to the Company, including advertising, reservation and

ground handling services. Expenses paid to Delta under these arrangements were $75,000, $8,924,000

and $6,741,000 during the years ended December 31, 2002, 2001 and 2000, respectively. United also

provides services to the Company consisting of reservation, passenger and ground handling services.

The Company paid $10,602,000, $8,884,000 and $7,199,000 to United for services during the years

ended December 31, 2002, 2001 and 2000, respectively.

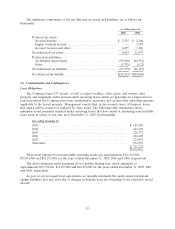

The Company’s President, Chairman and Chief Executive Officer, serves on the Board of Directors

for Zion’s Bancorporation (‘‘Zion’s’’) and The Regence Group (‘‘Regence’’). The Company maintains a

line of credit (see Note 2) and certain bank accounts with Zion’s, Zion’s is an equity participant in

leveraged leases on two CRJ aircraft operated by the Company and Zion’s provides investment

administrative services to the Company for which the Company paid approximately $165,000 and

$173,000 during the years ended December 31, 2002 and 2001, respectively. The balances in the Zion’s

accounts as of December 31, 2002 and 2001 were $4,923,000 and $15,390,000, respectively. Regence

provides administrative services and medical stop loss coverage for various health care plans for the

Company. The Company paid Regence $904,000 and $1,889,000 for these services during the years

ended December 31, 2002 and 2001, respectively.

ITEM 9. CHANGES IN AND DISAGREEMENTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

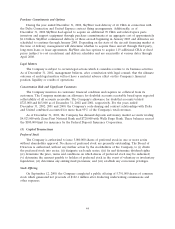

On June 24, 2002, the Company dismissed its independent auditor, Arthur Andersen LLP (‘‘Arthur

Andersen’’), and appointed KPMG LLP (‘‘KPMG’’) as its new independent auditor. These actions were

approved by the Company’s Board of Directors upon the recommendation of its Audit Committee and

were reported in a Current Report on Form 8-K, filed with the Commission on June 28, 2002, as

amended by an Amendment to Current Report on Form 8-K/A, filed with the Commission on July 15,

2002.

During the years ended December 31, 2001 and 2000, and the subsequent interim period through

June 24, 2002, there was no disagreement between the Company and Arthur Andersen on any matter

of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which

disagreement, if not resolved to Arthur Andersen’s satisfaction, would have caused Arthur Andersen to

make reference to the subject matter of such disagreement in connection with its reports, and there

occurred no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K promulgated by the

Securities and Exchange Commission.

The audit reports of Arthur Andersen on the consolidated financial statements of the Registrant

for the years ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of

opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the years ended December 31, 2001 and 2000, and the subsequent interim period through

June 24, 2002, the date KPMG was appointed as the Company’s independent auditor, the Registrant

did not consult with KPMG regarding any of the matters or events set forth in Item 304(a)(2)(i) and

(ii) of Regulation S-K.

In connection with the preparation of the Current Report on Form 8-K, as amended, described in

the first paragraph above, the Company provided a copy of the foregoing disclosures to Arthur

Andersen, but Arthur Andersen declined to issue a letter as required by Item 304 (a) (3) of

Regulation S-K. The Registrant has been informed by Arthur Andersen that Arthur Andersen does not

have the resources available to take the actions necessary to prepare and issue such a letter.

47