SkyWest Airlines 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

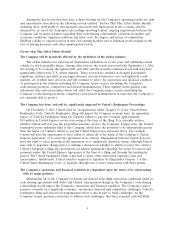

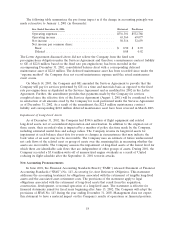

The following table summarizes the pro forma impact as if the change in accounting principle was

made retroactive to January 1, 2001 (in thousands):

Year Ended December 31, 2001: Historical Pro Forma

Operating expenses ................................ $536,301 $532,788

Operating income ................................. 65,564 69,077

Net income ..................................... 50,516 52,659

Net income per common share:

Basic ........................................ $ 0.90 $ 0.93

Diluted ....................................... 0.88 0.92

The Letter Agreement discussed above did not relieve the Company from the fixed rate

per-engine-hour obligation under the Services Agreement and therefore a maintenance contract liability

to GE of $22.8 million, based on the fixed rate per-engine-hour, has been recorded in the

accompanying December 31, 2002, consolidated balance sheet with a corresponding deferred

maintenance asset of $22.8 million. The deferred maintenance asset has been recorded since under the

‘‘expense method’’ the Company does not record maintenance expense until the actual maintenance

event occurs.

On March 14, 2003, the Company and GE amended the Services Agreement to provide that the

Company will pay for services performed by GE on a time and materials basis as opposed to the fixed

rate per-engine-hour as stipulated in the Services Agreement and as modified for 2002 in the Letter

Agreement. Further, the amendment provides that payments made by the Company for services

completed since the effective date of the Services Agreement (August 1, 2001) will be considered to be

in satisfaction of all amounts owed by the Company for work performed under the Services Agreement

as of December 31, 2002. As a result of the amendment, the $22.8 million maintenance contract

liability and corresponding $22.8 million deferred maintenance asset have been reversed in March 2003.

Impairment of Long Lived Assets

As of December 31, 2002, the Company had $344.6 million of flight equipment and related

long-lived assets, net of accumulated depreciation and amortization. In addition to the original cost of

these assets, their recorded value is impacted by a number of policy elections made by the Company,

including estimated useful lives and salvage values. The Company reviews its long-lived assets for

impairment at each balance sheet date for events or changes in circumstances that may indicate the

book value of an asset may not be recoverable. The Company uses an estimate of future undiscounted

net cash flows of the related asset or group of assets over the remaining life in measuring whether the

assets are recoverable. The Company assesses the impairment of long-lived assets at the lowest level for

which there are identifiable cash flows that are independent of other groups of assets. During 2001, the

Company recorded a $3.4 million write-off of unamortized engine overhauls as a result of United

reducing its flight schedule after the September 11, 2001 terrorist attacks.

New Accounting Pronouncements

In June 2001, the Financial Accounting Standards Board (‘‘FASB’’) released Statement of Financial

Accounting Standards (‘‘SFAS’’) No. 143, Accounting for Asset Retirement Obligations. This statement

addresses the accounting treatment for obligations associated with the retirement of tangible long-lived

assets and the associated asset retirement costs. The provisions of the statement apply to legal

obligations associated with the retirement of long-lived assets that result from the acquisition,

construction, development, or normal operation of a long-lived asset. The statement is effective for

financial statements issued for fiscal years beginning after June 15, 2002. The Company will adopt the

provisions of SFAS No. 143 during the year ending December 31, 2003. Management does not expect

this statement to have a material impact on the Company’s results of operations or financial position.

18