SkyWest Airlines 2002 Annual Report Download - page 28

Download and view the complete annual report

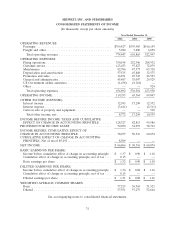

Please find page 28 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fuel costs decreased as a percentage of airline operating revenues to 12.0% for the year ended

December 31, 2001 from 13.0% for the year ended December 31, 2000. This decrease was primarily

due to the average price of fuel decreasing 13.4% per gallon to $1.03 from $1.19. Fuel costs per ASM

decreased to 2.6¢ for the year ended December 31, 2001 from 3.0¢ for the year ended December 31,

2000.

Other expenses, primarily consisting of commissions, landing fees, station rentals, computer

reservation system fees and hull and liability insurance, increased as a percentage of airline operating

revenues to 20.5% for the year ended December 31, 2001 from 18.5% for the year ended

December 31, 2000. The increase was primarily the result of SkyWest aircraft being grounded because

of the September 11, 2001 terrorist attacks and the increase in liability insurance as a result of the

September 11th events. Expenses other than insurance per ASM remained constant at 4.3¢ for

both years ended December 31, 2001 and 2000 due to the change in mix from the thirty-seat Brasilias

to the fifty-seat CRJs.

In September 2001, the U.S. Federal Government passed the Air Transportation Safety and System

Stabilization Act (the ‘‘Act’’). Under the Act, funds were made available to compensate air carriers for

direct losses suffered as a result of any Federal ground stop order and incremental losses beginning

September 11, 2001, and ending December 31, 2001, resulting from the September 11, 2001, terrorist

attacks on the United States. During the year ended December 31, 2001, the Company recognized

approximately $8.2 million under the Act as a contra expense in its consolidated statement of income.

Liquidity and Capital Resources

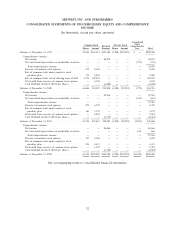

The Company had working capital of $391.8 million and a current ratio of 4.2:1 at December 31,

2002, compared to working capital of $270.8 million and a current ratio of 3.3:1 at December 31, 2001.

The increase in working capital was primarily the result of an increase of $88.3 million in net cash

provided by operations during the year ended December 31, 2002. The principal sources of cash

included $173.7 million provided by operating activities, $24.8 million of proceeds from the issuance of

long-term debt, $18.8 million of proceeds from the sale of property and equipment, $8.9 million from

the sale of common stock in connection with the exercise of stock options and the Company’s

Employee Stock Purchase Plan and $4.5 million in net deposits on aircraft and rotables. During 2002,

the Company invested $82.8 million in flight equipment, $26.3 million in marketable securities and

$16.1 million in buildings, ground equipment and other assets. The Company also reduced long-term

debt by $12.7 million and paid $4.6 million in cash dividends.

The Company’s position in marketable securities, consisting primarily of bonds, bond funds and

commercial paper, increased to $294.5 million at December 31, 2002, compared to $268.0 million at

December 31, 2001. At December 31, 2002, the Company’s total capital mix was 83.6% equity and

16.4% debt, compared to 82.7% equity and 17.3% debt at December 31, 2001.

The Company spent approximately $72.5 million for non-aircraft capital expenditures during the

year ended December 31, 2002. These expenditures consisted primarily of $23.4 million for rotable

spares, $17.5 million for aircraft engine overhauls, $15.5 million for aircraft improvements, and

$16.1 million for buildings and ground equipment and other assets.

The Company has a $10.0 million unsecured bank line of credit through January 31, 2004, with

interest payable at the bank’s base rate less one-quarter percent, which was a net rate of 4.0% at

December 31, 2002. As of December 31, 2002, the Company had $6.0 million of letters of credit and

no borrowings outstanding under this line of credit. The Company believes that in the absence of

unusual circumstances the working capital available to the Company will be sufficient to meet its

present requirements, including expansion, capital expenditures, lease payments and debt service

requirements for at least the next 12 months.

24