SkyWest Airlines 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

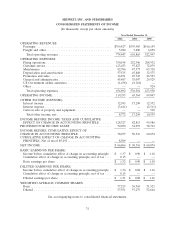

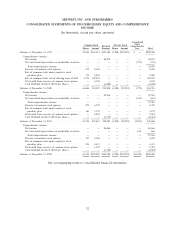

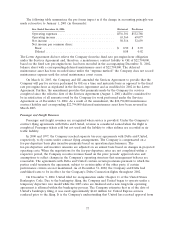

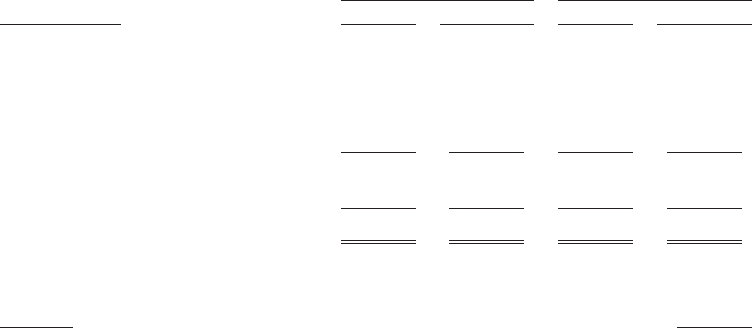

specific identification method, is recognized as a component of operating results. The Company’s

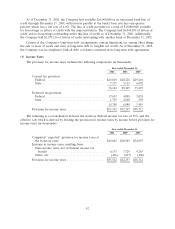

position in marketable securities as of December 31, 2002 and 2001 is as follows (in thousands):

2002 2001

Investment Types Cost Market Value Cost Market Value

Commercial paper ............. $ 10,019 $ 10,019 $ 7,307 $ 7,390

Bond funds .................. 232,891 230,858 187,427 184,295

Corporate notes .............. 35,597 35,439 61,198 61,599

Asset backed securities ......... 18,288 18,148 10,623 10,670

Other ...................... — — 4,073 4,068

296,795 294,464 270,628 268,022

Unrealized depreciation ......... (2,331) — (2,606) —

Total ....................... $294,464 $294,464 $268,022 $268,022

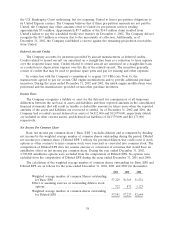

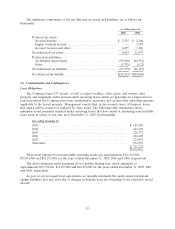

Marketable securities had the following maturities as of December 31, 2002 (in thousands):

Maturities Amount

Year 2003 ............................................... $229,407

Years 2004 through 2005 .................................... 60,114

Thereafter ............................................... 4,943

The Company has classified all marketable securities as short-term since it has the intent to

maintain a liquid portfolio and the ability to redeem the securities within the year.

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an

allowance for obsolescence based on historical results and management’s expectations of future

operations. Expendable inventory parts are charged to expense as used.

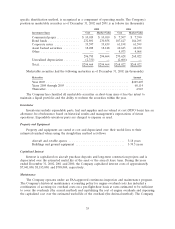

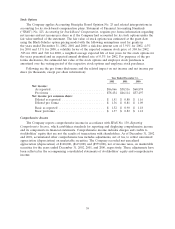

Property and Equipment

Property and equipment are stated at cost and depreciated over their useful lives to their

estimated residual values using the straight-line method as follows:

Aircraft and rotable spares ................................ 3-18 years

Buildings and ground equipment ............................ 3-39.5 years

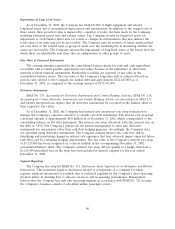

Capitalized Interest

Interest is capitalized on aircraft purchase deposits and long-term construction projects and is

depreciated over the estimated useful life of the asset or the aircraft lease term. During the years

ended December 31, 2002, 2001 and 2000, the Company capitalized interest costs of approximately

$7,041,000, $5,185,000, and $788,000, respectively.

Maintenance

The Company operates under an FAA-approved continuous inspection and maintenance program.

The Company’s historical maintenance accounting policy for engine overhaul costs has included a

combination of accruing for overhaul costs on a per-flight-hour basis at rates estimated to be sufficient

to cover the overhauls (the accrual method) and capitalizing the cost of engine overhauls and expensing

the capitalized cost over the estimated useful life of the overhaul (the deferral method). The Company

35