SkyWest Airlines 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the U.S. Bankruptcy Court authorizing, but not requiring, United to honor pre-petition obligations to

its United Express carriers. The Company believes that if these pre-petition amounts are not paid by

United, the Company may offset amounts owed to United for pre-petition services totaling

approximately $3.6 million. Approximately $9.7 million of the $14.0 million claim resulted from

United’s failure to pay the scheduled weekly wire transfer on December 6, 2002. The Company did not

recognize the $9.7 million as revenue due to the uncertainty of collection. Additionally, as of

December 31, 2002, the Company established a reserve against the remaining pre-petition receivables

from United.

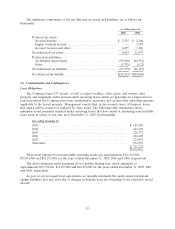

Deferred Aircraft Credits

The Company accounts for incentives provided by aircraft manufacturers as deferred credits.

Credits related to leased aircraft are amortized on a straight-line basis as a reduction to lease expense

over the respective lease term. Credits related to owned aircraft are amortized on a straight-line basis

as a reduction to depreciation expense over the life of the related aircraft. The incentives generally

consist of credits that may be used to purchase spare parts and pay for training and other expenses.

In connection with the Company’s commitment to acquire 119 CRJs (see Note 4), the

manufacturer agreed to pay for certain CRJ engine modifications and to provide additional purchase

incentives. During the years ended December 31, 2002 and 2001, the initial engine modifications were

performed and the manufacturer provided certain other purchase incentives.

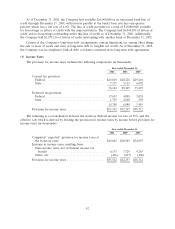

Income Taxes

The Company recognizes a liability or asset for the deferred tax consequences of all temporary

differences between the tax basis of assets and liabilities and their reported amounts in the consolidated

financial statements that will result in taxable or deductible amounts in future years when the reported

amounts of the assets and liabilities are recovered or settled. As of December 31, 2002 and 2001, the

Company had recorded current deferred tax assets of $6,812,000 and $11,079,000, respectively (which

are included in other current assets), and deferred tax liabilities of $63,379,000 and $41,173,000,

respectively.

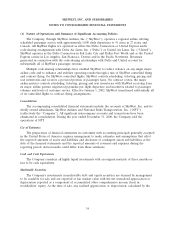

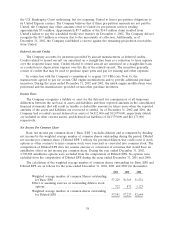

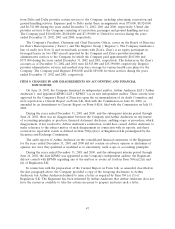

Net Income Per Common Share

Basic net income per common share (‘‘Basic EPS’’) excludes dilution and is computed by dividing

net income by the weighted average number of common shares outstanding during the period. Diluted

net income per common share (‘‘Diluted EPS’’) reflects the potential dilution that could occur if stock

options or other contracts to issue common stock were exercised or converted into common stock. The

computation of Diluted EPS does not assume exercise or conversion of securities that would have an

antidilutive effect on net income per common share. During the year ended December 31, 2002,

2,790,000 antidilutive options were excluded from the computation of Diluted EPS. No options were

excluded from the computation of Diluted EPS during the years ended December 31, 2001 and 2000.

The calculation of the weighted average number of common shares outstanding for Basic EPS and

Diluted EPS are as follows for the years ended December 31, 2002, 2001 and 2000 (in thousands):

2002 2001 2000

Weighted average number of common Shares outstanding

for Basic EPS ............................... 57,229 56,365 51,521

Effect of assuming exercise of outstanding dilutive stock

options .................................... 322 872 1,123

Weighted average number of common shares outstanding

for Diluted EPS ............................. 57,551 57,237 52,644

38