SkyWest Airlines 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

continue in the future and may ultimately result in some or all of the Company’s employees being

represented by a union.

The Company is subject to significant governmental regulation

All interstate air carriers, including SkyWest, are subject to regulation by the DOT, the FAA and

other governmental agencies. Regulations promulgated by the DOT primarily relate to economic

aspects of air service. The FAA requires operating, air worthiness and other certificates; approval of

personnel who may engage in flight, maintenance or operation activities; record keeping procedures in

accordance with FAA requirements; and FAA approval of flight training and retraining programs. The

Company cannot predict whether it will be able to comply with all present and future laws, rules,

regulations and certification requirements or that the cost of continued compliance will not have a

material adverse effect on operations.

The occurrence of an aviation accident would negatively impact the Company’s operations and

financial condition

An accident or incident involving one of the Company’s aircraft could involve repair or

replacement of a damaged aircraft and its consequential temporary or permanent loss from service, and

significant potential claims of injured passengers and others. The Company is required by the DOT to

carry liability insurance. In the event of an accident, the Company’s liability insurance may not be

adequate and the Company may be forced to bear substantial losses from the accident. Substantial

claims resulting from an accident in excess of the Company’s related insurance coverage would harm

operational and financial results. Moreover, any aircraft accident or incident, even if fully insured,

could cause a public perception that the Company is less safe or reliable than other airlines.

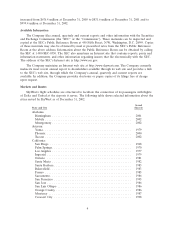

ITEM 2. PROPERTIES

Flight Equipment

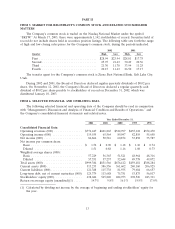

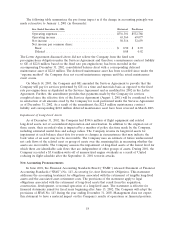

As of December 31, 2002, SkyWest owned or leased the following types of aircraft:

Scheduled Average

Number of Flight Cruising Average

Aircraft Passenger Range Speed Age

Type of Aircraft Owned Leased Capacity (Miles) (MPH) (Years)

Brasilia ...................... 21 55 30 300 300 7.4

Canadair Regional Jet ........... 6 67 50 850 530 2.0

SkyWest’s aircraft are turboprop and jet aircraft designed to operate more economically over

short-haul routes with lower passenger load factors than larger jet aircraft. These factors make it

economically feasible for SkyWest to provide high frequency service in markets with relatively low

volumes of passenger traffic. Passenger comfort features of these aircraft include stand-up headroom, a

lavatory, overhead baggage compartments and flight attendant service. Fiscal year 1995 marked the

introduction of the CRJs. As of February 28, 2003, SkyWest operated 84 of these aircraft on stage

lengths up to 850 miles.

During 2002, SkyWest took delivery of 26 CRJs in connection with the Delta Connection and

United Express expansion. Additionally, as of December 31, 2002, SkyWest had agreed to acquire an

additional 70 CRJs and related spare parts inventory and support equipment at an aggregate cost of

approximately $1.4 billion. SkyWest commenced delivery of these aircraft in January 2003 and deliveries

are scheduled to continue through January 2005. Depending on the state of the aircraft financing

market at the time of delivery, management will determine whether to acquire these aircraft through

third party, long-term loans or lease arrangements. SkyWest also has options to acquire 119 additional

11