SkyWest Airlines 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(6) Retirement Plan and Employee Stock Purchase Plan

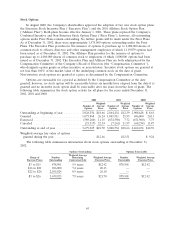

Retirement Plan

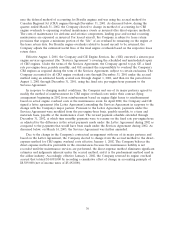

The Company sponsors the SkyWest Airlines Employees’ Retirement Plan (the ‘‘Plan’’). Employees

who have completed 90 days of service and are 18 years of age are eligible for participation in the

Plan. Employees may elect to make contributions to the Plan. The Company matches 100% of such

contributions up to 2%, 4% or 6% of the individual participant’s compensation, based upon length of

service. Additionally, a discretionary contribution may be made by the Company. The Company’s

combined contributions to the Plan were $7,466,000, $6,128,000 and $5,242,000 for the years ended

December 31, 2002, 2001 and 2000, respectively.

Employee Stock Purchase Plan

In February 1996, the Company’s Board of Directors approved the SkyWest, Inc. 1995 Employee

Stock Purchase Plan (‘‘The Stock Purchase Plan’’). All employees who have completed 90 days of

employment are eligible to participate, except employees who own five percent or more of the

Company’s common stock. The Stock Purchase Plan enables employees to purchase shares of the

Company’s common stock at a 15% discount, through payroll deductions. Employees can contribute

two to 15% of their base pay, not to exceed $21,250 each calendar year, for the purchase of shares. For

the year ended December 31, 2002, 214,131 shares were purchased by employees at prices of $21.63

and $19.88 per share. For the year ended December 31, 2001, 162,922 shares were purchased by

employees at prices of $23.80 and $15.75 per share. For the year ended December 31, 2000, 179,978

shares were purchased by employees at prices of $11.90 and $11.04 per share. In addition, as of

December 31, 2002, $2,555,000 had been withheld for the future purchase of shares. Shares are

purchased semi-annually at the lower of the beginning or the end of the period price. Employees can

terminate their participation in the Stock Purchase Plan at anytime upon written notice.

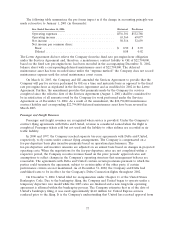

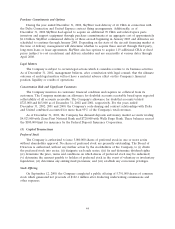

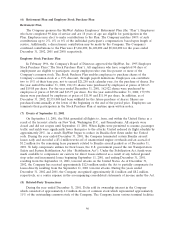

(7) Events of September 11, 2001

On September 11, 2001, the FAA grounded all flights to, from, and within the United States as a

result of the terrorist attacks on New York, Washington D.C., and Pennsylvania. All airports were

closed and did not reopen until September 13, 2001. When flights were permitted to resume, passenger

traffic and yields were significantly lower than prior to the attacks. United reduced its flight schedule by

approximately 20%. As a result, SkyWest began to reduce its Brasilia fleet flown under the United

code. During the year ended December 31, 2001, the Company terminated certain Brasilia aircraft

leases early and recorded a $3.4 million write-off of unamortized engine overhauls and an accrual of

$1.2 million for the remaining lease payments related to Brasilia aircraft parked as of December 31,

2001. To help compensate airlines for their losses, the U.S. government passed the Air Transportation

Safety and System Stabilization Act (the ‘‘Stabilization Act’’). Under the Stabilization Act, funds were

made available to compensate air carriers for direct losses suffered as a result of any federal ground

stop order and incremental losses beginning September 11, 2001, and ending December 31, 2001,

resulting from the September 11, 2001, terrorist attacks on the United States. As of December 31,

2002, the Company has received approximately $12.6 million under the Act to partially compensate for

losses directly resulting from the September 11, 2001 terrorist attacks. During the years ended

December 31, 2002 and 2001, the Company recognized approximately $1.4 million and $8.2 million,

respectively, as a contra expense in the accompanying consolidated statements of income under the Act.

(8) Related-Party Transactions

During the year ended December 31, 2001, Delta sold its ownership interest in the Company

which consisted of approximately 6.2 million shares of common stock which represented approximately

11% of the outstanding common stock of the Company. The Company leases various terminal facilities

46