SkyWest Airlines 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

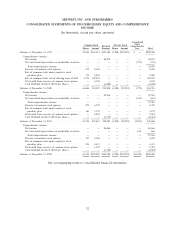

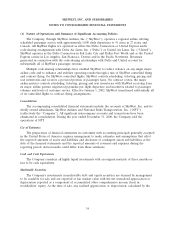

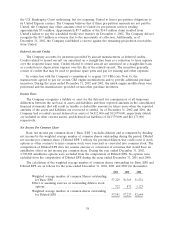

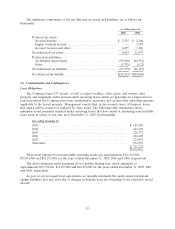

The following table summarizes the pro forma impact as if the change in accounting principle was

made retroactive to January 1, 2001 (in thousands):

Year Ended December 31, 2001: Historical Pro Forma

Operating expenses ................................ $536,301 $532,788

Operating income ................................. 65,564 69,077

Net income ..................................... 50,516 52,659

Net income per common share:

Basic ........................................ $ 0.90 $ 0.93

Diluted ....................................... 0.88 0.92

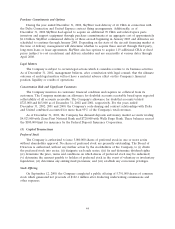

The Letter Agreement did not relieve the Company from the fixed rate per-engine-hour obligation

under the Services Agreement and, therefore, a maintenance contract liability to GE of $22,794,000,

based on the fixed rate per-engine-hour, has been recorded in the accompanying December 31, 2002,

balance sheet with a corresponding deferred maintenance asset of $22,794,000. The deferred

maintenance asset has been recorded since under the ‘‘expense method’’ the Company does not record

maintenance expense until the actual maintenance event occurs.

On March 14, 2003, the Company and GE amended the Services Agreement to provide that the

Company will pay for services performed by GE on a time and materials basis as opposed to the fixed

rate per-engine-hour as stipulated in the Services Agreement and as modified for 2002 in the Letter

Agreement. Further, the amendment provides that payments made by the Company for services

completed since the effective date of the Services Agreement (August 1, 2001) shall be considered to

be in satisfaction of all amounts owed by the Company for work performed under the Services

Agreement as of December 31, 2002. As a result of the amendment, the $22,794,000 maintenance

contract liability and corresponding $22,794,000 deferred maintenance asset have been reversed in

March 2003.

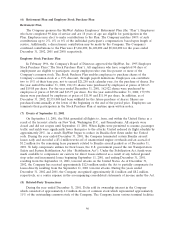

Passenger and Freight Revenues

Passenger and freight revenues are recognized when service is provided. Under the Company’s

contract flying agreements with Delta and United, revenue is considered earned when the flight is

completed. Passenger tickets sold but not used and the liability to other airlines are recorded as air

traffic liability.

In 2000 and 1997, the Company reached separate ten-year agreements with Delta and United,

respectively, to fly routes under contract flying arrangements. The Company is compensated on a

fee-per-departure basis plus incentive payments based on operational performance. The

fee-per-departure and incentive amounts are adjusted on an annual basis based on changes in projected

operating costs. When the negotiations for the fee-per-departure rates are not completed within a

respective period, the Company records revenues based on the prior periods’ approved rates and

assumptions to reflect changes in the Company’s operating structure that management believes are

reasonable. The agreements with Delta and United contain certain provisions pursuant to which the

parties could terminate the agreement, subject to certain rights of the other party, if certain

performance criteria are not maintained. As of December 31, 2002, the Company and Delta had

established rates to be in effect for the Company’s Delta Connection flights throughout 2002.

On December 9, 2002, United filed for reorganization under Chapter 11 of the United States

Bankruptcy Code. Due to the bankruptcy filing, the Company and United began to operate under a

temporary departure rate model while the 2003 rates are finalized and a new long-term operating

agreement is affirmed within the bankruptcy process. The Company estimates that as of the date of

United’s bankruptcy filing, it was owed approximately $14.0 million for United Express services

rendered prior to the filing. It is the Company’s understanding that United has received approval from

37