SkyWest Airlines 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.uses the deferral method of accounting for Brasilia engines and was using the accrual method for

Canadair Regional Jet (CRJ) engines through December 31, 2001. As discussed below, during the

quarter ended March 31, 2002, the Company elected to change its method of accounting for CRJ

engine overhauls to expensing overhaul maintenance events as incurred (the direct-expense method).

The costs of maintenance for airframe and avionics components, landing gear and normal recurring

maintenance are expensed as incurred. For leased aircraft, the Company is subject to lease return

provisions that require a minimum portion of the ‘‘life’’ of an overhaul be remaining on the engine at

the lease return date. For Brasilia engine overhauls related to leased aircraft to be returned, the

Company adjusts the estimated useful lives of the final engine overhauls based on the respective lease

return dates.

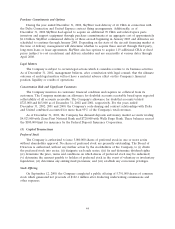

Effective August 1, 2001, the Company and GE Engine Services, Inc. (GE) executed a sixteen-year

engine services agreement (the ‘‘Services Agreement’’) covering the scheduled and unscheduled repair

of CRJ engines. Under the terms of the Services Agreement, the Company agreed to pay GE a fixed

rate per-engine-hour, payable monthly, and GE assumed the responsibility to overhaul the Company’s

CRJ engines as required during the term of the Services Agreement, subject to certain exclusions. The

Company accounted for all CRJ engine overhaul costs through December 31, 2001 under the accrual

method using an estimated hourly accrual rate through August 1, 2001, and then for the period from

August 1, 2001 through December 31, 2001, using the fixed rate per-engine-hour pursuant to the

Services Agreement.

In response to changing market conditions, the Company and one of its major partners agreed to

modify the method of reimbursement for CRJ engine overhaul costs under their contract flying

arrangement beginning in 2002 from reimbursement based on engine flight hours to reimbursement

based on actual engine overhaul costs at the maintenance event. In April 2002, the Company and GE

signed a letter agreement (the Letter Agreement) amending the Services Agreement in response to the

change with the Company’s major partner. Pursuant to the Letter Agreement, payments under the

Services Agreement were modified from the per-engine-hour basis, payable monthly, to a time and

materials basis, payable at the maintenance event. The revised payment schedule extended through

December 31, 2002, at which time monthly payments were to resume on the fixed rate per-engine-hour,

as adjusted for the difference in the actual payments made under the Letter Agreement during 2002 as

compared to the payments that would have been made under the Services Agreement during 2002. As

discussed below, on March 14, 2003, the Services Agreement was further amended.

Due to the change in the Company’s contractual arrangement with one of its major partners and

based on the Letter Agreement, the Company elected to change from the accrual method to the direct-

expense method for CRJ engine overhaul costs effective January 1, 2002. The Company believes the

direct-expense method is preferable in the circumstances because the maintenance liability is not

recorded until the maintenance services are performed, the direct-expense method eliminates significant

estimates and judgments inherent under the accrual method, and it is the predominant method used in

the airline industry. Accordingly, effective January 1, 2002, the Company reversed its engine overhaul

accrual that totaled $14,081,000 by recording a cumulative effect of change in accounting principle of

$8,589,000 (net of income taxes of $5,492,000).

36