SkyWest Airlines 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

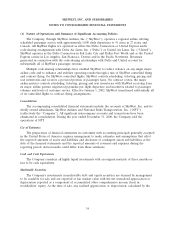

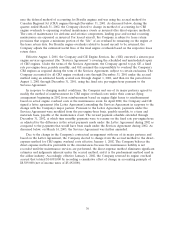

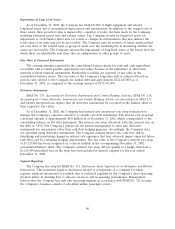

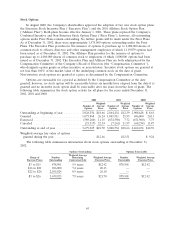

(2) Long-term Debt

Long-term debt consisted of the following as of December 31, 2002 and 2001 (in thousands):

2002 2001

Notes payable to banks, due in semi-annual installments plus

interest at 6.06% to 6.45% through 2018, secured by aircraft $ 63,722 $ 50,086

Notes payable to banks, due in semi-annual installments plus

interest at 3.72% to 3.86%, net of the benefits of interest

rate subsidies through the Brazilian Export financing

program, through 2011, secured by aircraft ............. 20,339 22,438

Note payable to bank, due in semi-annual installments plus

interest at 7.18% through 2012, secured by aircraft ....... 15,080 15,808

Notes payable to banks, due in monthly installments including

interest at 6.70% to 7.37% through 2006, secured by aircraft 11,490 15,674

Note payable to bank, due in semi-annual installments plus

interest based on six- month LIBOR (1.38% at

December 31, 2002) through 2016, secured by aircraft ..... 14,482 15,044

Note payable to bank, due in monthly installments plus

interest based on LIBOR through 2012, secured by buildings 8,772 —

Other notes payable, secured by aircraft ................. 4,026 6,789

137,911 125,839

Less current maturities ............................. (12,532) (12,151)

$125,379 $113,688

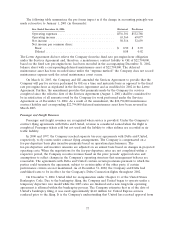

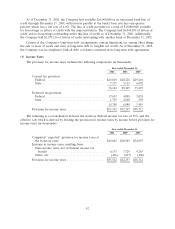

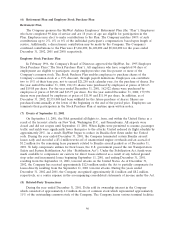

The aggregate amounts of principal maturities of long-term debt as of December 31, 2002 were as

follows (in thousands):

Year ending December 31,

2003 ................................................... $ 12,532

2004 ................................................... 11,831

2005 ................................................... 11,736

2006 ................................................... 7,731

2007 ................................................... 8,056

Thereafter ............................................... 86,025

$137,911

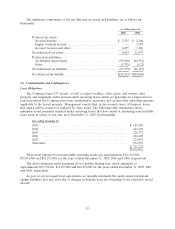

The Company’s long-term debt was incurred in connection with the acquisition of Brasilia and

CRJ aircraft. Certain amounts related to the Brasilia aircraft are supported by continuing subsidy

payments through the export support program of the Federative Republic of Brazil. The subsidy

payments reduce the stated interest rates to an average effective rate of approximately 3.7%, on

$15.5 million of the long-term debt, at December 31, 2002. The continuing subsidy payments are at risk

to the Company if the Federative Republic of Brazil does not meet its obligations under the export

support program. While the Company has no reason to believe, based on information currently

available, that the Company will not continue to receive these subsidy payments from the Federative

Republic of Brazil in the future, there can be no assurance that such a default will not occur. On the

remaining long-term debt related to the Brasilia aircraft of $20.3 million, the lender has assumed the

risk of the subsidy payments which has reduced the average effective rate on this debt to approximately

3.8% at December 31, 2002. The average effective rate on the debt related to the CRJ aircraft of

$93.3 million was 6.1% at December 31, 2002, and is not subject to subsidy payments.

41