SkyWest Airlines 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

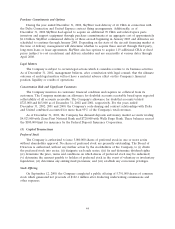

As of December 31, 2002, the Company had available $10,000,000 in an unsecured bank line of

credit through December 15, 2004, with interest payable at the bank’s base rate less one-quarter

percent, which was a net rate of 4.0%. The line of credit provides for a total of $10,000,000 available

for borrowings or letters of credit with the same institution. The Company had $6,044,834 of letters of

credit and no borrowings outstanding under this line of credit as of December 31, 2002. Additionally,

the Company had $1,275,216 of letters of credit outstanding with another bank at December 31, 2002.

Certain of the Company’s long-term debt arrangements contain limitations on, among other things,

the sale or lease of assets and ratio of long-term debt to tangible net worth. As of December 31, 2002,

the Company was in compliance with all debt covenants contained in its long-term debt agreements.

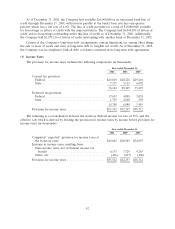

(3) Income Taxes

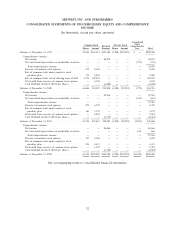

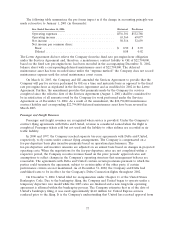

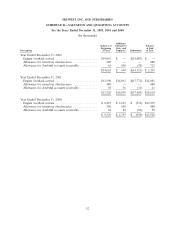

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2002 2001 2000

Current tax provision:

Federal ................................. $29,029 $20,226 $29,201

State ................................... 7,155 5,123 6,092

36,184 25,349 35,293

Deferred tax provision:

Federal ................................. 17,651 4,088 3,024

State ................................... 1,707 2,860 395

19,358 6,948 3,419

Provision for income taxes ..................... $55,542 $32,297 $38,712

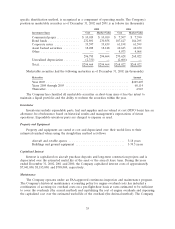

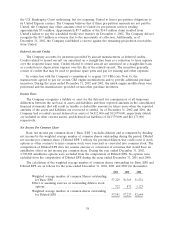

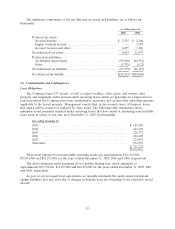

The following is a reconciliation between the statutory Federal income tax rate of 35% and the

effective rate which is derived by dividing the provision for income taxes by income before provision for

income taxes (in thousands):

Year ended December 31,

2002 2000 2001

Computed ‘‘expected’’ provision for income taxes at

the statutory rates ......................... $49,845 $28,985 $34,855

Increase in income taxes resulting from:

State income taxes, net of Federal income tax

benefit ................................ 6,133 3,729 4,263

Other, net ............................... (436) (417) (406)

Provision for income taxes ..................... $55,542 $32,297 $38,712

42