SkyWest Airlines 2002 Annual Report Download - page 14

Download and view the complete annual report

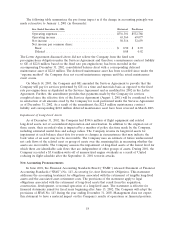

Please find page 14 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.continue to require, the Company’s participation in efforts to reduce costs and improve the financial

position of the Company’s partners. Management believes these developments will impact many aspects

of the Company’s operations and financial performance. In particular, the Company anticipates that its

financial performance, including its margins, will be less predictable than in prior periods and will be

negatively impacted as the industry under goes significant restructuring.

Terrorist activities or warnings have dramatically impacted, and will likely continue to impact, the

Company

The terrorist attacks of September 11, 2001 and their aftermath have negatively impacted the

airline industry in general and the Company’s operations in particular. The primary effects experienced

by the airline industry included substantial losses of passenger traffic and related revenue, increased

security and insurance costs, increased concerns about future terrorist attacks, airport delays due to

heightened security and significantly reduced yields due to the decrease in demand for air travel.

Additional terrorist attacks, the fear of such attacks, the recent commencement of war in Iraq,

other hostilities in the Middle East or other regions could negatively impact the airline industry, and

result in further decreased passenger traffic and yields, increased flight delays or cancellations

associated with new government mandates, as well as increased security, fuel and other costs. The

Company cannot provide any assurance that these events will not adversely impact the airline industry

generally or the Company’s results of operations and financial condition.

The Company’s reliance on only two aircraft types exposes the Company to a number of potentially

significant risks

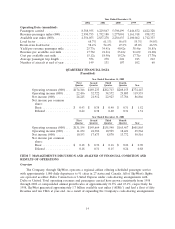

As of December 31, 2002, the Company had a fleet of 76 Brasilias and 73 CRJs. During the year

ended December 31, 2002, 73.5% of the Company’s ASMs were flown by CRJs and 26.5% were flown

by Brasilias. Additionally, as of December 31, 2002 the Company had commitments to acquire an

additional 70 CRJs through January 2005 and options to acquire an additional 119 CRJs. The

Company is subject to various risks related to its current fleet and the ability to operate the additional

aircraft that could materially or adversely effect its results of operations and financial condition,

including:

• the Company’s ability to obtain necessary financing to fulfill the Company’s contractual

obligations related to the acquisition of CRJs,

• breach by Bombardier, Inc. of the Company’s firm order contracts for the delivery of 70 CRJs or

any change in the delivery schedule of such CRJs,

• the interruption of fleet service as a result of unscheduled or unanticipated maintenance

requirements for such aircraft,

• the issuance of FAA directives restricting or prohibiting the use of Brasilias or CRJs, or

• the adverse public perception of an aircraft type as a result of an accident or other adverse

publicity

The possible unionization of the Company’s employees could impact the Company’s business

The employees of the Company are not currently represented by any union. Management is aware

that collective bargaining group organization efforts among its employees occur from time to time and

expect that such efforts will continue in the future. If unionizing efforts are successful, the Company

may be subjected to risks of work interruption or stoppage and/or incur additional administrative

expenses associated with union representation. Management recognizes that such efforts will likely

10