SkyWest Airlines 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

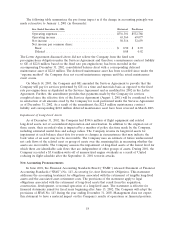

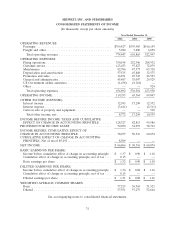

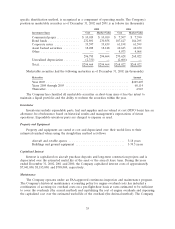

Significant Commitments and Obligations

The following table summarizes the Company’s commitments and obligations as of December 31,

2002 for each of the next five years and thereafter (in thousands):

Total 2003 2004 2005 2006 2007 Thereafter

Firm aircraft commitments .... $1,385,500 $633,600 $633,600 $118,300 $ — $ — $ —

Operating lease payments for

aircraft and facility obligations 1,499,607 127,458 121,601 126,372 126,608 123,001 874,567

Principal maturities on long-

term debt ............... 137,911 12,532 11,831 11,736 7,731 8,056 86,025

Total commitments and

obligations .............. $3,023,018 $773,590 $767,032 $256,408 $134,339 $131,057 $960,592

During the year ended December 31, 2002, SkyWest took delivery of 26 CRJs in connection with

the Delta Connection and United Express expansion. Additionally, as of December 31, 2002, SkyWest

had agreed to acquire an additional 70 CRJs and related spare parts inventory and support equipment

at an aggregate cost of approximately $1.4 billion. SkyWest commenced delivery of these aircraft in

January 2003 and deliveries are scheduled to continue through January 2005. Depending on the state of

the aircraft financing market at the time of delivery, management will determine whether to acquire

these aircraft through, long-term loans or lease arrangements. SkyWest also has options to acquire 119

additional CRJs at fixed prices (subject to cost escalations) and delivery schedules. The options are

exercisable at various dates through April 2008.

The Company has significant long-term lease obligations primarily relating to its aircraft fleet.

These leases are classified as operating leases and therefore are not reflected as liabilities in the

Company’s consolidated balance sheets. At December 31, 2002, the Company leased 127 aircraft with

remaining lease terms ranging from one to 16 years. Future minimum lease payments due under all

long-term operating leases were approximately $1.5 billion at December 31, 2002. At a 7.5% discount

factor, the present value of these lease obligations would be approximately $971.8 million at

December 31, 2002.

The Company’s long-term debt was incurred in connection with the acquisition of Brasilia and

CRJ aircraft. Certain amounts related to the Brasilia aircraft are supported by continuing subsidy

payments through the export support program of the Federative Republic of Brazil. The subsidy

payments reduce the stated interest rates to an average effective rate of approximately 3.7%, on

$15.5 million of the long-term debt, at December 31, 2002. The continuing subsidy payments are at risk

to the Company if the Federative Republic of Brazil does not meet its obligations under the export

support program. While the Company has no reason to believe, based on information currently

available, that the Company will not continue to receive these subsidy payments from the Federative

Republic of Brazil in the future, there can be no assurance that such a default will not occur. On the

remaining long-term debt related to the Brasilia aircraft of $20.3 million, the lender has assumed the

risk of the subsidy payments and the average effective rate on this debt is approximately 3.8% at

December 31, 2002. The average effective rate on the debt related to the CRJ aircraft of $93.3 million

was 6.1% at December 31, 2002, and is not subject to subsidy payments.

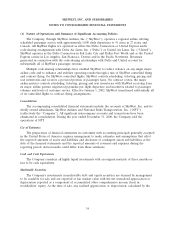

Seasonality

As is common in the airline industry, SkyWest’s operations are favorably affected by increased

travel, historically occurring in the summer months, and are unfavorably affected by decreased business

travel during the months from November through January and by inclement weather which occasionally

results in cancelled flights, principally during the winter months. However, SkyWest does expect some

25