SkyWest Airlines 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Among the key factors that may have a direct bearing on the Company’s operating results are risks

and uncertainties described in the following section entitled ‘‘Factors That May Affect Future Results,’’

including those attributable to developments associated with fluctuations in the economy and the

demand for air travel, the bankruptcy proceedings involving United, ongoing negotiations between the

Company and its major partners regarding their code-sharing relationships; variations in market and

economic conditions; employee relations and labor costs, the degree and nature of competition,

SkyWest’s ability to expand services in new and existing markets and to maintain profit margins in the

face of pricing pressures and other unanticipated factors.

Factors that May Affect Future Results

The Company will be materially affected by the turbulence of the airline industry

The airline industry has experienced tremendous turbulence in recent years and will likely remain

volatile for the foreseeable future. Among other factors, the events associated with September 11, 2001,

the slowing U.S. economy throughout 2001 and 2002 and the recently commenced war with Iraq have

significantly affected the U.S. airline industry. These events have resulted in changed government

regulation, declines and shifts in passenger demand, increased insurance costs and tightened credit

markets, all of which have affected, and will continue to affect, the operations and financial condition

of participants in the industry including the Company, major carriers (including the Company’s

code-sharing partners), competitors and aircraft manufacturers. These industry developments raise

substantial risks and uncertainties which will affect the Company, major carriers (including the

Company’s code-sharing partners), competitors and aircraft manufacturers in ways that the Company is

not currently able to predict.

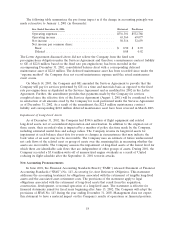

The Company has been, and will be, significantly impacted by United’s Bankruptcy Proceedings

On December 9, 2002, United filed for reorganization under Chapter 11 of the United States

Bankruptcy Code. United’s Bankruptcy filing will impact the Company in many ways. An immediate

impact of United’s bankruptcy filing was United’s failure to pay the Company approximately

$14 million in United Express service fees owing at the time of the filing. It is currently unclear

whether United will ever pay the prepetition amounts owed to the Company. Longer-term, the United

bankruptcy poses additional risks to the Company, which have the potential to be substantially greater

than the impact of United’s failure to pay the United Express fees discussed above. For example,

United will have the opportunity to elect either to affirm all of the terms of the Company’s United

Express Agreement, or to reject the agreement in its entirety. Management believes United does not

have the right to reject portions of the agreement or to unilaterally amend its terms, although United

may seek to negotiate changes prior to making a decision on whether to affirm or reject the contract.

United’s bankruptcy filing also necessitates an interim agreement regarding the status of services and

payments under the United Express Agreement at the time of a filing and through the bankruptcy

period. The United bankruptcy filing could lead to many other unforeseen expenses, risks and

uncertainties. Additionally, United could be required to liquidate by filing under Chapter 7 of the

United States Bankruptcy Code, or liquidate through one or more transactions with third parties.

The Company’s operations and financial condition are dependent upon the terms of its relationships

with its major partners

Substantially all of the Company’s revenues are derived from flight operations conducted under its

code-sharing agreements with Delta and United. Any material change in the Company’s code-sharing

relationships would impact the Company’s operations and financial condition. The Company’s major

partners currently face significant economic, operational, financial and competitive challenges. United’s

bankruptcy filing and associated reorganization effort is due in part to these challenges. As the

Company’s major partners restructure to address such challenges, they have required, and will likely

9