SkyWest Airlines 2002 Annual Report Download - page 23

Download and view the complete annual report

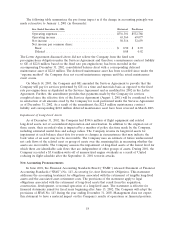

Please find page 23 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In August 2001, the FASB issued SFAS No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets. This statement supercedes SFAS No. 121, Accounting for the Impairment of

Long-Lived Assets and for Long-Lived Assets to be Disposed Of, and the accounting and reporting

provisions of Accounting Principles Board (‘‘APB’’) Opinion No. 30, Reporting Results of Operations—

Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently

Occurring Events and Transactions. SFAS No. 144 requires that the same accounting model be used for

long-lived assets to be disposed of by sale, whether previously held and used or newly acquired, and it

broadens the presentation of discontinued operations to include more disposal transactions. The

Company adopted the provisions of SFAS No. 144 on January 1, 2002, which did not have an impact

on the Company’s results of operations or financial position.

In April 2002, the FASB issued SFAS No. 145, Rescission of FASB Statements No. 4, 44, and 64,

Amendment of FASB Statement No. 13, and Technical Corrections. SFAS No. 145 states that gains and

losses from extinguishment of debt that do not meet the criteria for classification as extraordinary items

in APB Opinion No. 30, should not be classified as extraordinary items. Accordingly, SFAS No. 145

rescinds SFAS No. 4, Reporting Gains and Losses from Extinguishment of Debt, and SFAS No. 64,

Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements. SFAS No. 145 is effective for the

Company on January 1, 2003 and is not expected to have a material impact on the Company’s results

of operations or financial position.

In June 2002, the FASB issued SFAS No. 146, Accounting for Costs Associated with Exit or Disposal

Activities. This statement applies to costs associated with an exit activity, including restructuring

activities, or with the disposal of long-lived assets. Exit activities can include eliminating or reducing

product lines, terminating employees and related contracts, and relocating plant facilities or personnel.

Under the provisions of SFAS No. 146, entities will be required to record a liability for a cost

associated with an exit or disposal activity when that liability is incurred and can be measured at fair

value. The provisions of SFAS No. 146 are effective for exit activities initiated after December 31, 2002.

Management does not expect that the adoption of this statement will have a material impact upon the

Company’s results of operations or financial position.

In November 2002, the FASB released FASB Interpretation No. 45 (‘‘FIN 45’’), Guarantor’s

Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of

Others: an interpretation of FASB Statements No. 5, 57, and 107 and rescission of FASB Interpretation

No. 34. FIN 45 establishes new disclosure and liability-recognition requirements for direct and indirect

debt guarantees with specified characteristics. The initial measurement and recognition requirements of

FIN 45 are effective prospectively for guarantees issued or modified after December 31, 2002.

However, the disclosure requirements are effective for interim and annual financial-statement periods

ending after December 15, 2002. The Company adopted the disclosure requirements of FIN 45 for the

year ended December 31, 2002 and will be required to adopt the measurement and recognition

provisions of FIN 45 in the first quarter of 2003. Management of the Company does not expect the

adoption of the measurement and recognition provisions of FIN 45 to have a material impact on the

Company’s results of operations or financial position.

In December 2002, the FASB issued SFAS No. 148, Accounting for Stock-Based Compensation—

Transition and Disclosure—an amendment of FASB Statement No. 123, SFAS No. 148 is effective for

fiscal years beginning after December 15, 2002 and amends SFAS No. 123, Accounting for Stock-Based

Compensation, to provide alternative methods of transition for a voluntary change to the fair value

based method of accounting for stock-based employee compensation. In addition, SFAS No. 148

amends the disclosure requirements of SFAS No. 123 to require prominent disclosures in both annual

and interim financial statements about the method of accounting for stock-based employee

compensation and the effect of the method used on reported results. The Company adopted SFAS

No. 148 as of December 31, 2002. The effect of the adoption of this statement was not material as the

Company continues to use the intrinsic value method allowed under SFAS No. 123.

19