SkyWest Airlines 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

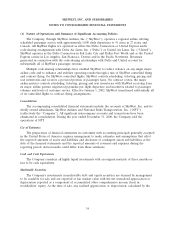

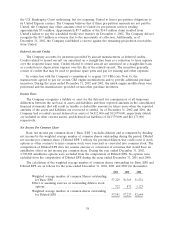

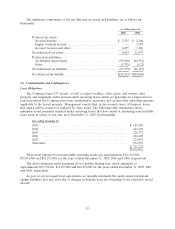

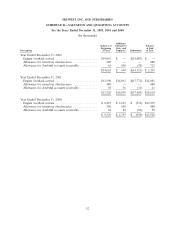

The significant components of the net deferred tax assets and liabilities are as follows (in

thousands):

As of December 31,

2002 2001

Deferred tax assets:

Accrued benefits ................................ $ 2,555 $ 2,206

Engine overhaul accrual ........................... — 5,547

Accrued reserves and other ......................... 4,257 3,326

Total deferred tax assets ............................. 6,812 11,079

Deferred tax liabilities:

Accelerated depreciation ........................... (59,650) (40,551)

Other ........................................ (3,729) (622)

Total deferred tax liabilities .......................... (63,379) (41,173)

Net deferred tax liability ............................ $(56,567) $(30,094)

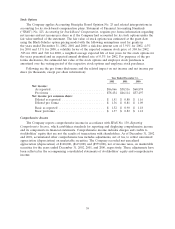

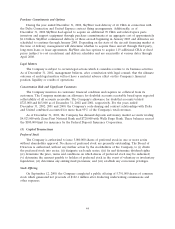

(4) Commitments and Contingencies

Lease Obligations

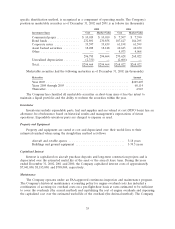

The Company leases 127 aircraft, as well as airport facilities, office space, and various other

property and equipment under noncancelable operating leases which are generally on a long-term net

rent basis where the Company pays taxes, maintenance, insurance and certain other operating expenses

applicable to the leased property. Management expects that, in the normal course of business, leases

that expire will be renewed or replaced by other leases. The following table summarizes future

minimum rental payments required under operating leases that have initial or remaining noncancelable

lease terms in excess of one year as of December 31, 2002 (in thousands):

Year ending December 31,

2003 .................................................. $ 127,458

2004 .................................................. 121,601

2005 .................................................. 126,372

2006 .................................................. 126,608

2007 .................................................. 123,001

Thereafter ............................................. 874,567

$1,499,607

Total rental expense for noncancelable operating leases was approximately $103,318,000,

$72,841,000 and $56,253,000, for the years ended December 31, 2002, 2001 and 2000, respectively.

The above minimum rental payments do not include landing fees, which amounted to

approximately $19,739,000, $14,877,000 and $10,873,000 for the years ended December 31, 2002, 2001

and 2000, respectively.

As part of our leveraged lease agreements, we typically indemnify the equity/owner participant

against liabilities that may arise due to changes in benefits from tax ownership of the respective leased

aircraft.

43