SkyWest Airlines 2002 Annual Report Download - page 26

Download and view the complete annual report

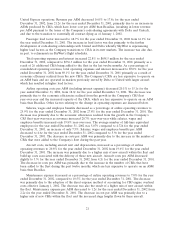

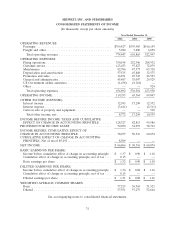

Please find page 26 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fuel costs increased as a percentage of airline operating revenues to 12.6% for the year ended

December 31, 2002 from 12.0% for the year ended December 31, 2001. However, the average price of

fuel decreased 5.8% per gallon to $0.97 from $1.03. As a result, fuel costs per ASM decreased to 2.2¢

for the year ended December 31, 2002 from 2.6¢ for the year ended December 31, 2001.

Other expenses, primarily consisting of commissions, landing fees, station rentals, computer

reservation system fees and hull and liability insurance, decreased as a percentage of airline operating

revenues to 18.4% for the year ended December 31, 2002 from 20.5% for the year ended

December 31, 2001. The decrease was primarily due to the economic efficiencies being realized due to

the addition of CRJs in new markets. Other expenses per ASM decreased 23.3% to 3.3¢ for the year

ended December 31, 2002 from 4.3¢ for the year ended December 31, 2001. The decrease in cost per

ASM was primarily due to the increase in the number of CRJs that have been added to the fleet

during the past twelve months, which are less expensive to operate on an ASM basis than the Brasilias.

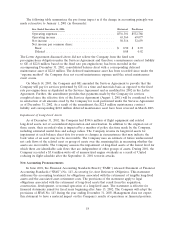

In September 2001, the U.S. federal government passed the Stabilization Act. Under the

Stabilization Act, funds were made available to compensate air carriers for direct losses suffered as a

result of any Federal ground stop order and incremental losses beginning September 11, 2001, and

ending December 31, 2002, resulting from the September 11, 2001, terrorist attacks on the United

States. As of December 31, 2002, the Company has received approximately $12.6 million under the Act

to partially compensate for losses resulting from the September 11, 2001 terrorist attacks. During

the years ended December 31, 2002 and 2001, the Company recognized approximately $1.4 and

$8.2 million, respectively, under the Act as a contra expense in its consolidated statements of income.

2001 Compared to 2000

Net income for the year ended December 31, 2001, was $50.5 million or $0.88 per share on a

diluted basis, compared to $60.9 million or $1.16 per share on a diluted basis for the year ended

December 31, 2000. The principal reason for the decrease in net income was the disruption of service

on September 11, 2001, when the FAA grounded all flights as a result of the terrorist attacks in New

York, Washington, D.C. and Pennsylvania and the subsequent decrease in demand for airline service.

Additionally, the Company experienced decreases in passenger revenues as a result of the weakening

economy. However, despite these factors, consolidated operating revenues increased 15.1% to

$601.9 million for the year ended December 31, 2001 from $523.0 million for the year ended

December 31, 2000.

Passenger revenues, which represented 99.0% of consolidated operating revenues, increased 15.5%

to $596.0 million for the year ended December 31, 2001 from $516.2 million or 98.7% of consolidated

operating revenues for the year ended December 31, 2000. The increase was due primarily to a 35.6%

increase in revenue passenger miles as the Company continued to increase its services with its

code-sharing partners and placed 33 CRJs in service. Eighteen were scheduled deliveries and 15 were

remarketed by the aircraft manufacturer. Twenty-seven of these aircraft were placed in service under

the Delta Connection operations and six were placed in service under the United Express operations.

Additionally, during the year ended December 31, 2001, the Company terminated certain Brasilia

aircraft leases early and recorded a $3.4 million write-off of unamortized engine overhauls and an

accrual of $1.2 million for the remaining lease payments for Brasilia aircraft parked as of December 31,

2001. Three other Brasilias were returned to the lessor due to normal lease expirations. Revenue per

available seat mile decreased 8.6% to 21.2¢ for the year ended December 31, 2001 from 23.2¢ for the

year ended December 31, 2000 primarily due to an increase in ASMs produced by CRJs and the

disruption in service resulting from the September 11th terrorist attacks.

Passenger load factor increased to 61.1% for the year ended December 31, 2001 from 56.6% for

the year ended December 31, 2000. The increase in load factor was due primarily to the further

development of code-sharing relationships with United and Delta whereby SkyWest experienced higher

22