SkyWest Airlines 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

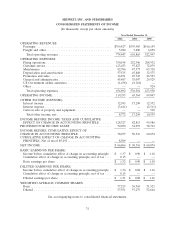

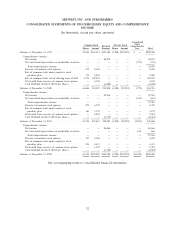

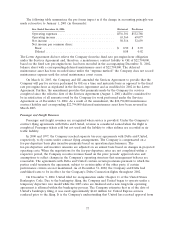

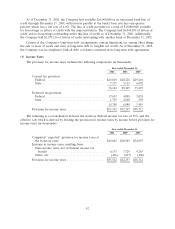

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2002 2001 2000

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income ................................................... $ 86,866 $ 50,516 $ 60,874

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ..................................... 57,535 45,888 32,575

Nonairline depreciation and amortization .............................. — — 498

Maintenance expense related to disposition of rotable spares .................. 1,379 1,947 2,235

Gain on sale of property and equipment ............................... — — (518)

Increase (decrease) in allowance for doubtful accounts ...................... 661 5 (144)

Increase in deferred income taxes ................................... 22,206 6,948 6,374

Tax benefit from exercise of common stock options ........................ 1,525 5,584 4,105

Deferred aircraft credits, net of accretion .............................. 10,903 15,127 —

Changes in operating assets and liabilities:

(Increase) decrease in receivables .................................. (6,890) 3,091 (17,916)

Increase in inventories ......................................... (3,750) (4,301) (3,518)

Increase in other current assets ................................... (1,988) (5,820) (2,379)

Increase (decrease) in accounts payable .............................. 3,313 12,783 (6,428)

Increase (decrease) in engine overhaul accrual .......................... (14,081) 1,091 2,722

Increase in other current liabilities ................................. 16,024 17,932 4,041

NET CASH PROVIDED BY OPERATING ACTIVITIES ..................... 173,703 150,791 82,521

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of marketable securities, net of sales ........................... (26,273) (41,590) (67,925)

Acquisition of property and equipment:

Aircraft and rotable spares ...................................... (82,759) (125,940) (75,828)

Deposits on aircraft ........................................... — (39,679) (49,265)

Buildings and ground equipment .................................. (11,760) (34,309) (15,490)

Proceeds from sales of property and equipment .......................... 18,785 517 5,030

Return of deposits on aircraft and rotable spares .......................... 4,541 22,297 5,800

Increase in other assets .......................................... (4,341) (920) (526)

NET CASH USED IN INVESTING ACTIVITIES .......................... (101,807) (219,624) (198,204)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of long-term debt .............................. 24,806 50,086 32,299

Principal payments on long-term debt ................................. (12,734) (10,173) (8,884)

Net proceeds from issuance of common stock ............................ 8,869 9,920 126,631

Payment of cash dividends ........................................ (4,569) (4,498) (3,829)

NET CASH PROVIDED BY FINANCING ACTIVITIES ..................... 16,372 45,335 146,217

Increase (decrease) in cash and cash equivalents ........................... 88,268 (23,498) 30,534

Cash and cash equivalents at beginning of year ............................ 42,692 66,190 35,656

CASH AND CASH EQUIVALENTS AT END OF YEAR .................... $130,960 $ 42,692 $ 66,190

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the year for:

Interest, net of capitalized amounts ................................. $ 2,205 $ — $ 3,231

Income taxes ............................................... $ 24,390 $ 17,951 $ 43,587

See accompanying notes to consolidated financial statements.

33