Singapore Airlines 2004 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2004

94 SIA Annual Report 03/04

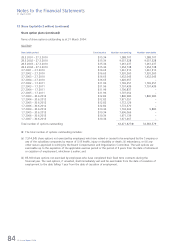

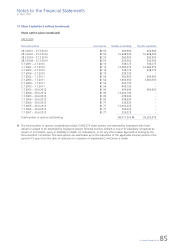

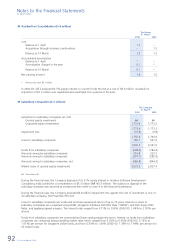

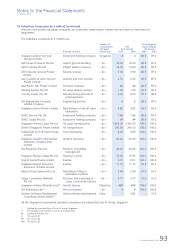

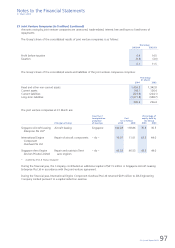

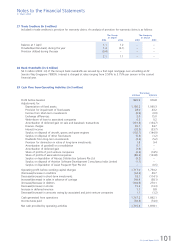

20 Associated Companies (in $ million)

The Group The Company

31 March 31 March

2004 2003 2004 2003

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Share of net tangible assets of associated

companies at acquisition date 375.7 371.2 – –

Goodwill on acquisition of associated companies 1,626.2 1,626.2 – –

–––––––––––––––––––––––––––––––––––

Unquoted investments at cost 2,001.9 1,997.4 1,725.0 1,724.1

Impairment loss (25.6) (25.6) (9.4) (9.4)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

1,976.3 1,971.8 1,715.6 1,714.7

Goodwill written-off to reserves (1,613.0) (1,613.0) – –

Accumulated amortization of goodwill on acquisition (7.6) (6.3) – –

Currency realignment 0.9 9.7 – –

Share of post acquisition reserves

– general reserve 130.8 125.5 – –

– capital reserve 22.9 – – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

510.3 487.7 1,715.6 1,714.7

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Loans to associated companies 17.8 23.1 7.1 7.1

Write-down of loans (10.6) (10.1) – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

7.2 13.0 7.1 7.1

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

517.5 500.7 1,722.7 1,721.8

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Amounts owing by associated companies 0.4 0.5 – –

Amounts owing to associated companies – (20.0) – (20.0)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Amounts owing by/(to) associated companies, net 0.4 (19.5) – (20.0)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

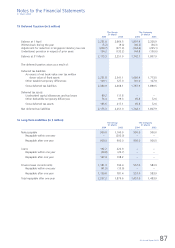

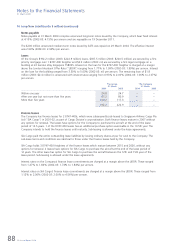

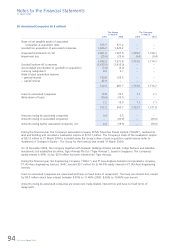

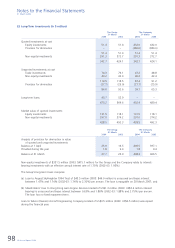

During the financial year, the Company’s associated company, RCMS Properties Private Limited (“RCMS”), revalued its

land and building and recorded a revaluation surplus of $114.7 million. The Company’s share of the revaluation surplus

of $22.9 million at 31 March 2004 is included under the Group’s share of post-acquisition capital reserve (refer to

Statement of Changes in Equity – The Group for the financial year ended 31 March 2004).

On 19 December 2003, the Company together with Temasek Holdings (Private) Limited, Indigo Partners and Irelandia

Investments Ltd established an airline, Tiger Airways Pte Ltd (“Tiger Airways”), based in Singapore. The Company’s

equity interest is 49%. So far, $0.9 million has been injected into Tiger Airways.

During the financial year, SIA Engineering Company (“SIAEC”) and PT Jasa Angkasa Semesta incorporated a company,

PT JAS Aero-Engineering Services. SIAEC injected $3.7 million for its 49.0% equity interest in PT JAS Aero-Engineering

Services.

Loans to associated companies are unsecured and have no fixed terms of repayments. The loans are interest-free, except

for $0.3 million which bear interest between 9.50% to 11.46% (2003: 8.69% to 19.45%) per annum.

Amounts owing by associated companies are unsecured, trade-related, interest-free and have no fixed terms of

repayments.