Singapore Airlines 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

SIA Annual Report 03/04

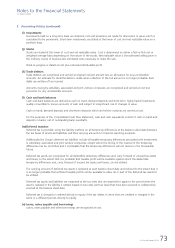

Notes to the Financial Statements

31 March 2004

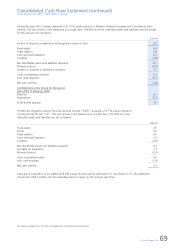

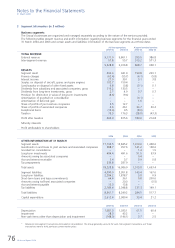

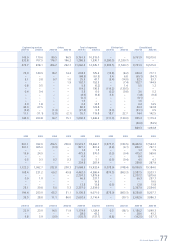

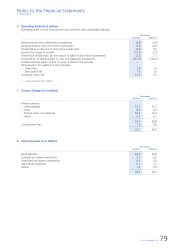

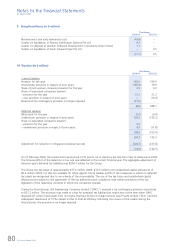

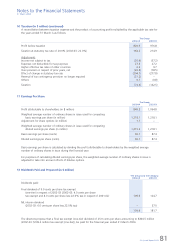

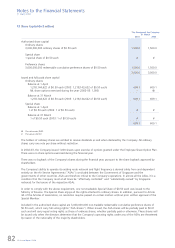

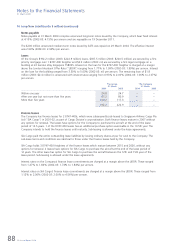

6 Operating Profit (in $ million)

Operating profit for the financial year was arrived at after charging/(crediting):

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interest income from short-term investments (0.4) (0.4)

Dividend income from short-term investments (0.5) (0.5)

(Surplus)/loss on disposal of short-term investments (2.6) 0.9

Income from lease of aircraft (31.7) (7.3)

(Write-back of)/provision for diminution in value of short-term investments (2.2) 2.1

Amortization of deferred gain on sale and leaseback transactions (131.8) (134.7)

Professional fees paid to a firm of which a director is a member **

Remuneration for auditors of the Company

Audit fees 1.0 1.0

Non-audit fees 1.0 1.4

Exchange losses, net 41.6 7.5

* Amount less than $0.1 million.

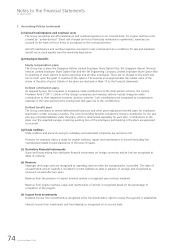

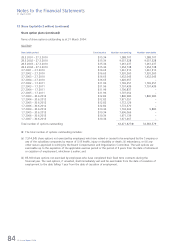

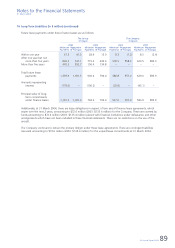

7 Finance Charges (in $ million)

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interest expense:

– notes payable 37.3 31.2

– loans 8.0 6.2

– finance lease commitments 18.3 16.3

– others 0.3 0.1

––––––––––––––––––––––––––––––––

63.9 53.8

Commitment fees 1.2 0.9

––––––––––––––––––––––––––––––––

65.1 54.7

––––––––––––––––––––––––––––––––

8 Interest Income (in $ million)

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fixed deposits 24.9 22.4

Quoted non-equity investments 5.1 6.9

Unquoted non-equity investments 0.6 0.9

Associated companies 0.1 1.1

Others 1.8 2.4

––––––––––––––––––––––––––––––––

32.5 33.7

––––––––––––––––––––––––––––––––