Singapore Airlines 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

SIA Annual Report 03/04

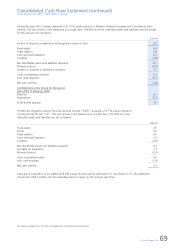

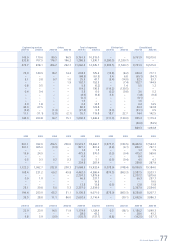

Consolidated Cash Flow Statement (continued)

For the financial year ended 31 March 2004 (in $ million)

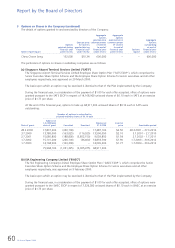

During the year, the Company disposed of its 51% equity interest in Aviation Software Development Consultancy India

Limited. This was shown in the statement as a single item. The effects of the individual assets and liabilities and the results

for the year are set out below.

2003-04

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Portion of disposal consideration discharged by means of cash 5.3

––––––––––––

Fixed assets 0.4

Trade debtors 2.8

Cash and bank balances 6.7

Creditors (1.8)

––––––––––––

Net identifiable assets and liabilities disposed 8.1

Minority interest (3.9)

Surplus on disposal of subsidiary company 1.1

––––––––––––

Cash consideration received 5.3

Less: cash disposed (6.7)

––––––––––––

Net cash outflow (1.4)

––––––––––––

Contributions to the Group for the period

April 2003 to February 2004:

Revenue 6.1

Expenditure (5.1)

––––––––––––

Profit before taxation 1.0

––––––––––––

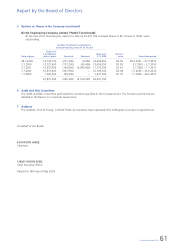

In 2002-03, Singapore Airport Terminal Services Limited (“SATS”) acquired a 57.1% equity interest in

Country Foods Pte Ltd (“CF”). This was shown in the statement as a single item. The effects on the

individual assets and liabilities are set out below.

2002-03

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fixed assets 2.9

Stocks 0.5

Trade debtors 2.0

Cash and bank balances 1.9

Creditors (2.6)

––––––––––––

Net identifiable assets and liabilities acquired 4.7

Goodwill on acquisition 1.3

Minority interest (2.0)

––––––––––––

Cash consideration paid 4.0

Less: cash acquired (1.9)

––––––––––––

Net cash outflow 2.1

––––––––––––

Subsequent acquisition of an additional 9.6% equity interest was by subscription of new shares in CF. The additional

investment of $2.0 million into the subsidiary has no impact on the Group’s cash flow.

The notes on pages 70 to 107 form an integral part of these financial statements.