Singapore Airlines 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

SIA Annual Report 03/04

Notes to the Financial Statements

31 March 2004

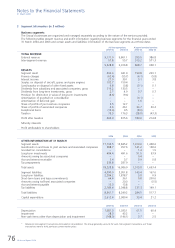

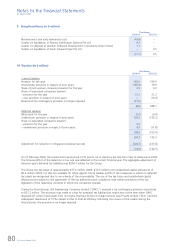

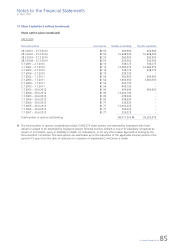

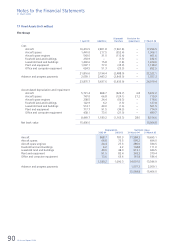

10 Taxation (in $ million) (continued)

A reconciliation between taxation expense and the product of accounting profit multiplied by the applicable tax rate for

the years ended 31 March is as follows:

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profit before taxation 820.9 976.8

––––––––––––––––––––––––––––––––

Taxation at statutory tax rate of 20.0% (2002-03: 22.0%) 164.2 214.9

Adjustments

Income not subject to tax (20.9) (37.2)

Expenses not deductible for tax purposes 27.8 27.2

Higher effective tax rates of other countries 6.2 9.7

Over provision in respect of prior years, net (26.5) (78.5)

Effect of change in statutory tax rate (204.7) (277.8)

Reversal of tax contingency provision no longer required (21.2) –

Others 0.7 (0.8)

––––––––––––––––––––––––––––––––

Taxation (74.4) (142.5)

––––––––––––––––––––––––––––––––

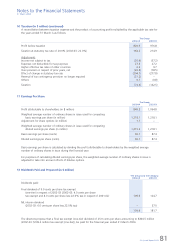

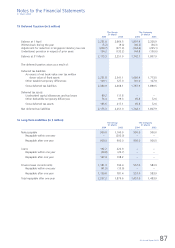

11 Earnings Per Share

The Group

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profit attributable to shareholders (in $ million) 849.3 1,064.8

––––––––––––––––––––––––––––––––

Weighted average number of ordinary shares in issue used for computing

basic earnings per share (in million) 1,218.1 1,218.1

Adjustment for share options (in million) 1.1 –

––––––––––––––––––––––––––––––––

Weighted average number of ordinary shares in issue used for computing

diluted earnings per share (in million) 1,219.2 1,218.1

––––––––––––––––––––––––––––––––

Basic earnings per share (cents) 69.7 87.4

––––––––––––––––––––––––––––––––

Diluted earnings per share (cents) 69.7 87.4

––––––––––––––––––––––––––––––––

Basic earnings per share is calculated by dividing the profit attributable to shareholders by the weighted average

number of ordinary shares in issue during the financial year.

For purposes of calculating diluted earnings per share, the weighted average number of ordinary shares in issue is

adjusted to take into account effects of dilutive options.

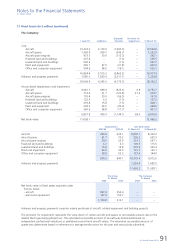

12 Dividends Paid and Proposed (in $ million)

The Group and the Company

2003-04 2002-03

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Dividends paid:

Final dividend of 9.0 cents per share tax exempt

(one-tier) in respect of 2002-03 (2002-03: 4.0 cents per share

tax exempt and 8.0 cents per share less 22.0% tax in respect of 2001-02) 109.6 124.7

NIL interim dividend

(2002-03: 6.0 cents per share less 22.0% tax) – 57.0

––––––––––––––––––––––––––––––––

109.6 181.7

––––––––––––––––––––––––––––––––

The directors propose that a final tax exempt (one-tier) dividend of 25.0 cents per share amounting to $304.5 million

(2002-03: $109.6 million tax exempt [one-tier]), be paid for the financial year ended 31 March 2004.