Singapore Airlines 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 SIA Annual Report 03/04

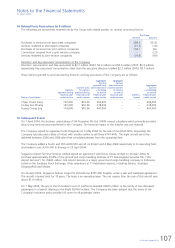

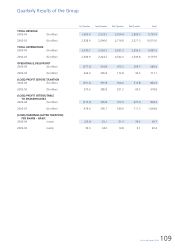

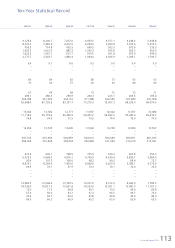

Five-Year Financial Summary of the Group

2003-04 2002-03 2001-02 2000-01 1999-00

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

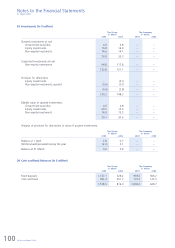

PROFIT AND LOSS ACCOUNT ($ million)

Total revenue 9,761.9 10,515.0 9,382.8 9,852.2 8,861.4

Total expenditure (9,081.5) (9,797.9) (8,458.2) (8,584.1) (7,843.3)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Operating profit 680.4 717.1 924.6 1,268.1 1,018.1

Finance charges (65.1) (54.7) (44.0) (37.5) (28.8)

Interest income 32.5 33.7 52.0 86.0 154.6

Surplus on disposal of aircraft, spares

and spare engines 102.7 144.9 66.0 181.3 98.4

Surplus/(loss) on disposal of other fixed assets 5.5 1.2 2.9 2.4 (0.8)

Dividend from long-term investments, gross 3.6 5.2 5.7 7.7 3.6

Provision for diminution in value of

long-term investments (1.8) (9.4) (1.1) (20.5) (6.7)

Surplus on disposal of long-term investments – – 4.4 3.0 –

Amortization of goodwill on consolidation (0.1) ––––

Amortization of deferred gain 1.6––––

Share of profits of joint venture companies 6.4 14.5 20.5 27.0 21.0

Share of profits/(losses) of associated companies 86.3 123.8 (71.3) 81.7 33.2

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profit before exceptional items 852.0 976.3 959.7 1,599.2 1,292.6

Surplus on liquidation of Abacus

Distribution Systems Pte Ltd 9.2 ––––

Surplus on disposal of Aviation Software

Development Consultancy India Limited 1.1 ––––

Retrenchment and early retirement costs (41.4) ––––

Surplus on liquidation of Asian Frequent

Flyer Pte Ltd – 0.5 – – –

Gain on sale of long-term investments – – 30.2 – 171.3

Provision for diminution in value of

investment in Air New Zealand Limited – – (266.9) – –

Recognition of deferred gain on

divestment of 51% equity interests in

Eagle Services Asia Private Limited – – 202.6 – –

Profit on disposal of vendor shares

(13% equity interests in SATS and SIAEC) – – – 440.1 –

Ex-gratia bonus payment – – – (134.6) –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profit before taxation 820.9 976.8 925.6 1,904.7 1,463.9

Profit attributable to shareholders 849.3 1,064.8 631.7 1,624.8 1,163.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

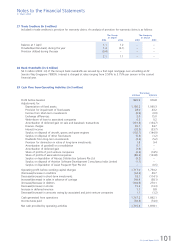

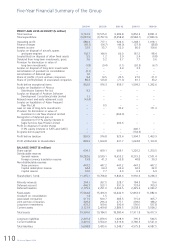

BALANCE SHEET ($ million)

Share capital 609.1 609.1 609.1 1,220.2 1,250.5

Distributable reserves

General reserve 10,282.6 9,539.1 8,655.2 8,215.2 7,501.4

Foreign currency translation reserve 19.8 41.3 63.8 40.8 30.3

Non-distributable reserves

Share premium 447.2 447.2 447.2 447.2 447.2

Capital redemption reserve 64.4 64.4 64.4 62.3 32.0

Capital reserve 32.0 7.7 6.9 6.9 6.9

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Shareholders’ funds 11,455.1 10,708.8 9,846.6 9,992.6 9,268.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Minority interests 304.1 267.5 228.7 184.5 19.6

Deferred account 446.7 523.1 591.9 733.4 709.3

Deferred taxation 2,175.3 2,251.0 2,664.5 2,425.6 2,333.2

Fixed assets 15,564.8 15,406.0 14,442.9 12,863.0 11,882.0

Goodwill on consolidation 1.4 1.5 – – –

Associated companies 517.5 500.7 385.5 715.4 305.7

Joint venture companies 309.2 296.4 277.1 239.0 188.2

Long-term investments 475.2 569.6 590.4 556.0 537.8

Current assets 3,121.9 2,409.8 2,884.5 3,538.5 3,504.2

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total assets 19,990.0 19,184.0 18,580.4 17,911.9 16,417.9

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Long-term liabilities 2,207.2 1,879.6 1,928.9 795.5 566.5

Current liabilities 3,401.6 3,554.0 3,319.8 3,780.3 3,521.0

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total liabilities 5,608.8 5,433.6 5,248.7 4,575.8 4,087.5

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––