Singapore Airlines 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIA Annual Report 03/04 37

Principle 12: The Board should ensure that the

M anagement maintains a sound system of internal

controls to safeguard the shareholders’ investments

and the company’s assets.

It is the opinion of the Board that, in the absence of evidence

to the contrary, the system of internal controls maintained

by the Company’s management and that was in place

throughout the financial year and up to the date of this

report provides reasonable, but not absolute, assurance

against material financial mis-statements or loss, and include

the safeguarding of assets, the maintenance of proper

accounting records, the reliability of financial information,

compliance with appropriate legislations, regulations and

best practices, and the identification and containment of

financial, operational and compliance risks. The Board notes

that all internal control systems contain inherent limitations

and no system of internal controls could provide absolute

assurance against the occurrence of material errors, poor

judgment in decision-making, human error, losses, fraud or

other irregularities.

A dedicated Risk Management Department was formed in

2003 to look into and manage the Company’s risk

management policies. The Risk Management Report can be

found in page 28 of this report.

Principle 13: The company should establish an internal

audit function that is independent of the activities it

audits.

The Internal Audit Department (IAD) is an independent

function that reports directly to the Audit & Risk Committee.

The IAD assists the Committee and the Board by performing

regular evaluations on the Company’s internal controls,

financial and accounting matters, compliance, business and

financial risk management policies and procedures, and

ensure that internal controls are adequate to meet the

Company’s requirements.

The Internal Audit Department will meet or exceed the

Standards for the Professional Practice of Internal Auditing

set by The Institute of Internal Auditors.

Principle 14: Companies should engage in regular,

effective and fair communication w ith shareholders.

It is the Company’s position that it is of ultimate importance

that shareholders are provided with prompt disclosure of

pertinent information. The Company also values dialogue

with both retail and institutional shareholders, and holds

media briefings when announcing half-yearly and year-end

results. The proceedings are concurrently broadcasted live

via webcast. Media briefings are also held as and when

necessary. Additionally, all financial results as well as price-

sensitive information are released through various media

which includes press releases, MASNET releases and/or

postings on the Company’s website, at www.singaporeair.com.

The Company’s Investor Relations Department meets with

key institutional investors on a regular basis, as well as answers

queries from shareholders from time to time.

The Company has clear policies and guidelines for dealings

in the securities of the Company by Directors and employees,

which are in conformity with the SGX-ST Best Practices Guide.

With the recent adoption of quarterly reporting, the Company

prohibits selected employees from trading in its securities for

the period commencing 2 weeks from announcement of

quarterly results; and a period commencing 1 month from

the announcement of year-end results.

Principle 15: Companies should encourage greater

shareholder participation at AGM s, and allow

shareholders the opportunity to communicate their

view s on various matters affecting the company.

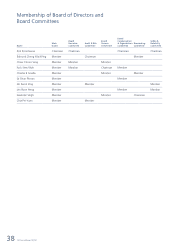

The Board members always endeavour to attend AGMs and

EGMs where shareholders are given the opportunity to raise

questions and clarify issues they may have relating to the

resolutions to be passed, with the Board. The Chairmen of

the Audit & Risk, Board Finance, Board Compensation &

Organisation, Nominating, and Safety and Reliability

Committees, or members of the respective committees

standing in for them, as well as the external auditors, will be

present and available to address questions at these meetings.