Singapore Airlines 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

SIA Annual Report 03/04

Financial Review

Performance of Subsidiary Companies (continued)

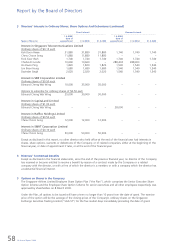

SIA Engineering Group

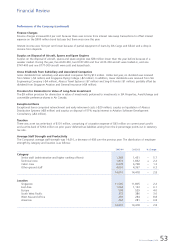

2003-04 2002-03

$ million $ million % Change

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total revenue 678.7 878.1 – 22.7

Total expenditure 599.8 737.1 – 18.6

Operating profit 78.9 141.0 – 44.0

Profit after taxation 140.0 205.3 – 31.8

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

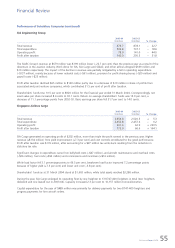

The SIAEC Group’s revenue at $679 million was $199 million lower (–22.7 per cent) than the previous year as a result of the

downturn in the aviation industry. Work done for SIA, SIA Cargo and SilkAir, and other airlines dropped $189 million and

$10 million respectively. The impact of the decline in revenue was partially mitigated by a fall in operating expenditure

(–$137 million), mainly because of lower material costs (–$61 million), provision for profit-sharing bonus (–$29 million) and

payroll costs (–$23 million).

Profit after taxation declined $65 million to $140 million partly due to a decrease of $19 million in share of profits from

associated and joint venture companies, which contributed 31.5 per cent of profit after taxation.

Shareholders’ funds rose 10.5 per cent to $926 million for the financial year ended 31 March 2004. Correspondingly, net

asset value per share increased 8.4 cents to 92.1 cents. Return on average shareholders’ funds was 15.9 per cent, a

decrease of 11.1 percentage points from 2002-03. Basic earnings per share fell 31.7 per cent to 14.0 cents.

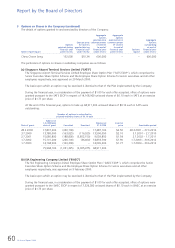

Singapore Airlines Cargo

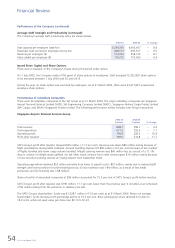

2003-04 2002-03

$ million $ million % Change

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total revenue 2,654.4 2,520.5 + 5.3

Total expenditure 2,452.8 2,457.6 – 0.2

Operating profit 201.6 62.9 + 220.5

Profit after taxation 175.9 66.6 + 164.1

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

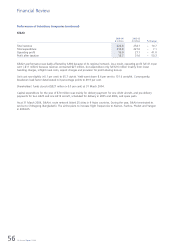

SIA Cargo generated an operating profit of $202 million, more than triple the profit earned in the previous year. Higher

revenue (+$134 million) from yield improvement (+7.3 per cent) and cost controls contributed to the good performance.

Profit after taxation was $176 million, after accounting for a $27 million tax write-back resulting from the reduction in

statutory tax rate.

Significant changes in expenditure came from bellyhold costs (–$67 million), and aircraft maintenance and overhaul costs

(–$26 million), fuel costs (+$54 million) and commissions and incentives (+$16 million).

While load factor fell 3.1 percentage points to 66.5 per cent, breakeven load factor improved 7.2 percentage points

because of higher yield (+7.3 per cent) and lower unit cost (–3.8 per cent).

Shareholders’ funds as at 31 March 2004 stood at $1,603 million, while total assets reached $3,286 million.

During the year, SIA Cargo enlarged its operating fleet by one freighter to 13 B747-400 freighters in total (two freighters

delivered and one leased out in 2003-04). Capacity increased 2.3 per cent to 10,157 million tonne-kilometres.

Capital expenditure for the year of $489 million was primarily for delivery payments for two B747-400 freighters and

progress payments for firm aircraft orders.