Singapore Airlines 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 SIA Annual Report 03/04

Notes to the Financial Statements

31 March 2004

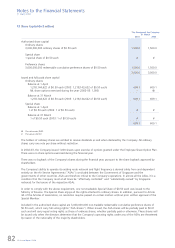

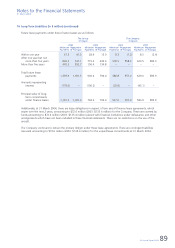

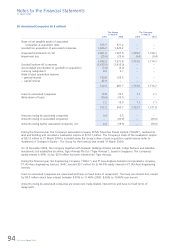

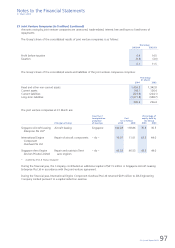

16 Long-Term Liabilities (in $ million) (continued)

Notes payable

Notes payable at 31 March 2004 comprise unsecured long-term notes issued by the Company, which bear fixed interest

at 4.15% (2002-03: 4.15%) per annum and are repayable on 19 December 2011.

The $200 million unsecured medium-term notes issued by SATS was repaid on 29 March 2004. The effective interest

was 2.94% (2002-03: 2.94%) per annum.

Loans

Of the Group’s $192.2 million (2003: $222.9 million) loans, $187.5 million (2003: $220.5 million) are secured by a first

priority mortgage over 1 B747-400 freighter and $2.9 million (2003: nil) are secured by a first legal mortgage on a

building at 22 Senoko Way Singapore 758095. Interest on the loan for the B747-400 freighter is charged at a margin

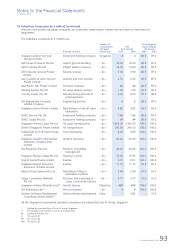

above the London Interbank Offer Rate (“LIBOR”) ranging from 1.77% to 1.99% (2002-03: 1.99%) per annum. Interest

on the loan for the building ranged from 3.50% to 5.00% (2002-03: nil) per annum. The remaining loan of $1.8

million (2003: $2.4 million) is unsecured with interest rates ranging from 0.93% to 2.00% (2002-03: 1.06% to 2.07%)

per annum.

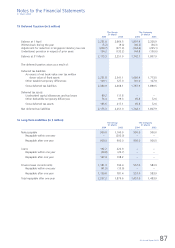

The Group The Company

31 March 31 March

2004 2003 2004 2003

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Within one year 24.8 24.7 – –

After one year but not more than five years 67.2 80.9 – –

More than five years 100.2 117.3 – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

192.2 222.9 – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

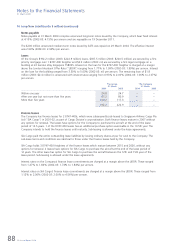

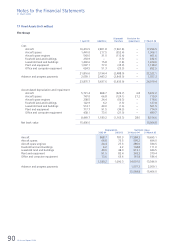

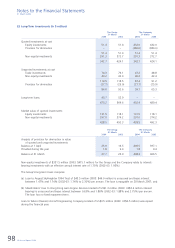

Finance leases

The Company has finance leases for 2 B747-400s, which were subsequently sub-leased to Singapore Airlines Cargo Pte

Ltd (“SIA Cargo”) in 2001-02, as part of Cargo Division’s corporatization. Both finance leases mature in 2007 without

any options for renewal. The leases have options for the Company to purchase the aircraft at the end of the lease

period of 12.5 years. 1 of the B747-400 leases has an additional purchase option exercisable in the 10.5th year. The

Company intends to hold the finance leases until maturity. Sub-leasing is allowed under the lease agreements.

SIA Cargo paid the entire outstanding lease liabilities by issuing ordinary shares at par for cash to the Company. The

sub-lease terms and conditions are identical to those under the finance leases held by the Company.

SIA Cargo holds 3 B747-400 freighters of the finance leases which mature between 2015 and 2026, without any

options for renewal. 2 leases have options for SIA Cargo to purchase the aircraft at the end of the lease period of

12 years. The other lease has option for SIA Cargo to purchase the aircraft between the 12th and 15th year of the

lease period. Sub-leasing is allowed under the lease agreements.

Interest rates on the Company’s finance lease commitments are charged at a margin above the LIBOR. These ranged

from 1.47% to 1.84% (2002-03: 1.74% to 1.84%) per annum.

Interest rates on SIA Cargo’s finance lease commitments are charged at a margin above the LIBOR. These ranged from

1.12% to 2.00% (2002-03: 2.00% to 4.56%) per annum.