Rite Aid 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

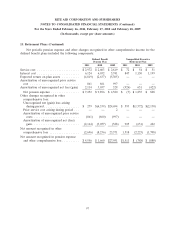

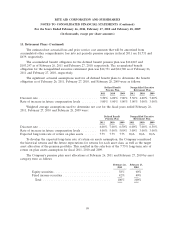

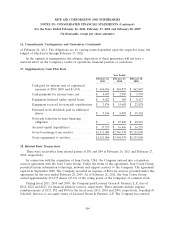

15. Retirement Plans

Defined Contribution Plans

The Company and its subsidiaries sponsor several retirement plans that are primarily 401(k)

defined contribution plans covering nonunion associates and certain union associates. The Company

does not contribute to all of the plans. Per those plan provisions, the Company matches 100% of a

participant’s pretax payroll contributions, up to a maximum of 3% of such participant’s pretax annual

compensation. Thereafter, the Company will match 50% of the participant’s additional pretax payroll

contributions, up to a maximum of 2% of such participant’s additional pretax annual compensation.

Total expense recognized for the above plans was $58,035 in fiscal 2011, $59,531 in fiscal 2010 and

$64,111 in fiscal 2009.

The Chairman of the Board and a member of the Board of Directors are entitled to supplemental

retirement defined contribution arrangements in accordance with their employment agreements, which

vest immediately. The Company makes investments to fund these obligations. Other officers, who are

not participating in the defined benefit nonqualified executive retirement plan, are included in a

supplemental retirement plan, which is a defined contribution plan that is subject to a five year

graduated vesting schedule. The expense (income) recognized for these plans was $9,433 in fiscal 2011,

$10,989 in fiscal 2010, and $(6,287) in fiscal 2009. The income recognized in fiscal 2009 is due to the

impact of market conditions on the plan liabilities.

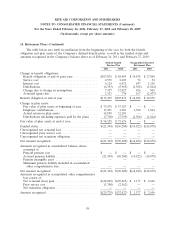

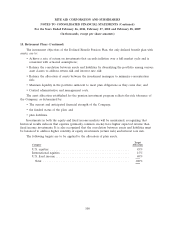

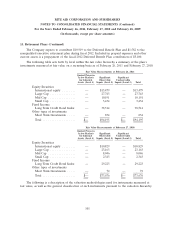

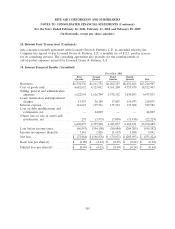

Defined Benefit Plans

The Company and its subsidiaries also sponsor a qualified defined benefit pension plan that

requires benefits to be paid to eligible associates based upon years of service and, in some cases,

eligible compensation. The Company’s funding policy for The Rite Aid Pension Plan (The ‘‘Defined

Benefit Pension Plan’’) is to contribute the minimum amount required by the Employee Retirement

Income Security Act of 1974. However, the Company may, at its sole discretion, contribute additional

funds to the plan. The Company made discretionary contributions of $13,451 in fiscal 2011, $2,681 in

fiscal 2010, and $1,174 in fiscal 2009.

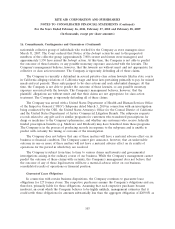

The Company has established the nonqualified executive retirement plan for certain officers who,

pursuant to their employment agreements, are not participating in the defined contribution

supplemental retirement plan. Generally, eligible participants receive an annual benefit, payable

monthly over fifteen years, equal to a percentage of the average of the three highest annual base

salaries paid or accrued for each participant within the ten fiscal years prior to the date of the event

giving rise to payment of the benefit. This defined benefit plan is unfunded.

96