Rite Aid 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

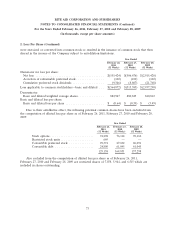

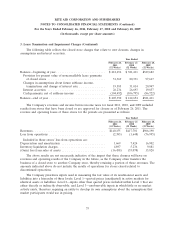

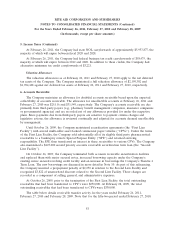

4. Discontinued Operations (Continued)

The Company has presented the operating results of and the gain on the sale of Las Vegas as a

discontinued operation in the statement of operations for fiscal 2009. The following amounts have been

segregated from continuing operations and included in discontinued operations:

Year Ended

February 28,

2009

(52 Weeks)

(Dollars in

thousands)

Revenues .............................................. $ 267

Costs and expenses:

Cost of goods sold ...................................... 1,652

Selling, general and administrative expenses ................... 1,936

Loss (gain) on sale of assets ............................... 48

Total costs and expenses ................................... 3,636

Loss from discontinued operations before income taxes ............. (3,369)

Income tax benefit ....................................... —

Net loss from discontinued operations ........................ $(3,369)

The assets and liabilities of the divested stores for the year ended February 28, 2009 are not

significant and have not been segregated in the consolidated balance sheets.

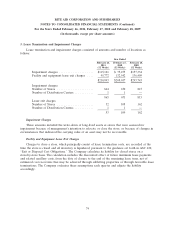

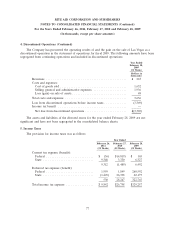

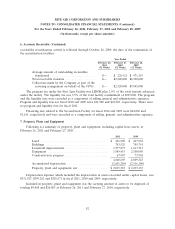

5. Income Taxes

The provision for income taxes was as follows:

Year Ended

February 26, February 27, February 28,

2011 2010 2009

(52 Weeks) (52 Weeks) (52 Weeks)

Current tax expense (benefit):

Federal ........................... $ (36) $(4,819) $ 165

State ............................. 9,348 3,330 6,327

9,312 (1,489) 6,492

Deferred tax expense (benefit):

Federal ........................... 1,959 1,849 260,592

State ............................. (1,429) 26,398 62,173

530 28,247 322,765

Total income tax expense ................ $9,842 $26,758 $329,257

77