Rite Aid 2011 Annual Report Download - page 36

Download and view the complete annual report

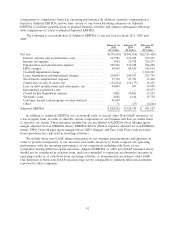

Please find page 36 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adjustments to prevent dilution, at any time. Proceeds from the issuance of these notes were used to

fund the redemption of our 6.125% notes due December 2008. We recorded a loss on debt

modification of $3.3 million related to the early redemption of the 6.125% notes due 2008, which

included payment of a make whole premium to the noteholders and unamortized debt issue costs on

the notes. As of February 26, 2011, $64.2 million aggregate principal amount of the notes remained

outstanding.

Preferred Stock Transactions

In the fourth quarter of fiscal 2009 the holder of substantially all of the outstanding shares of our

Series G preferred stock converted its shares into 27.1 million shares of our common stock at a

conversion rate of $5.50 per share.

In the third quarter of fiscal 2009, the remaining outstanding 2.4 million shares of Series I

preferred stock automatically converted into common stock, at a rate of 5.6561 common shares per

preferred share, which resulted in the issuance of 13.7 million shares of our common stock.

Sale Leaseback Transactions

During fiscal 2009 we sold a total of 72 owned stores to independent third parties. Net proceeds

from these sales were $193.0 million. Concurrent with these sales, we entered into agreements to lease

the stores back from the purchasers over minimum lease terms of 20 years. We accounted for 67 of

these leases as operating leases and the remaining five were initially accounted for using the financing

method as these lease agreements contain a clause that allow the buyer to force us to repurchase the

properties under certain conditions. A gain on the sale of these stores of $5.2 million was deferred and

is being recorded over the minimum term of these leases. Subsequent to February 28, 2009, the clause

that allowed the buyer to force us to repurchase the property lapsed on three of these leases.

Therefore, these leases are now accounted for as operating leases.

Off Balance Sheet Obligations

Until October 26, 2009, we maintained securitization agreements (the ‘‘First Lien Facility’’) with

several multi-seller asset-backed commercial paper vehicles (‘‘CPVs’’). Under the terms of the First

Lien Facility, we sold substantially all of our eligible third party pharmaceutical receivables to a

bankruptcy remote Special Purpose Entity (‘‘SPE’’) and retained servicing responsibility. The SPE then

transferred an interest in these receivables to various CPVs. We also maintained a $225.0 million

second priority accounts receivable securitization term loan (‘‘Second Lien Facility’’).

On October 26, 2009, we terminated both accounts receivable securitization facilities and replaced

them with senior secured notes, increased borrowing capacity under our existing senior secured

revolving credit facility and an increase in borrowings under our Tranche 4 Term Loan. As part of this

refinancing, we incurred a prepayment penalty of $2.3 million in relation to the Second Lien Facility

and recognized $3.8 million of unamortized discount related to the Second Lien Facility. These charges

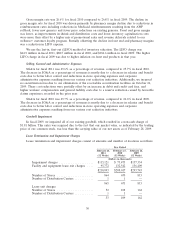

were recorded as a component of selling, general, and administrative expenses.

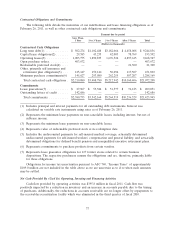

As of February 26, 2011, we had no material off balance sheet arrangements, other than operating

leases included in the table below.

36