Rite Aid 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

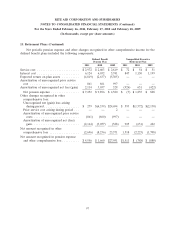

14. Stock Option and Stock Award Plans (Continued)

total intrinsic value of stock options exercised for fiscal 2011, 2010, and 2009 was $81, $44, and $239,

respectively.

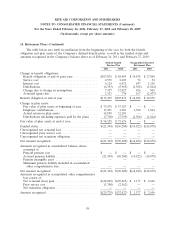

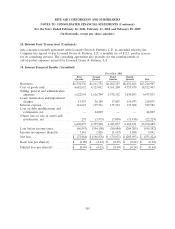

Restricted Stock

The Company provides restricted stock grants to associates under plans approved by the

stockholders. Shares awarded under the plans vest in installments up to three years and unvested shares

are forfeited upon termination of employment. Following is a summary of restricted stock transactions

for the fiscal years ended February 26, 2011, February 27, 2010, and February 28, 2009:

Weighted

Average

Grant Date

Shares Fair Value

Balance at March 1, 2008 ............................. 9,972 5.39

Granted ........................................ 2,647 0.94

Vested ......................................... (4,760) 5.19

Cancelled ....................................... (1,160) 4.86

Balance at February 28, 2009 .......................... 6,699 3.87

Granted ........................................ 3,289 1.28

Vested ......................................... (3,387) 4.35

Cancelled ....................................... (657) 3.03

Balance at February 27, 2010 .......................... 5,944 2.26

Granted ........................................ 4,574 1.07

Vested ......................................... (3,055) 3.21

Cancelled ....................................... (385) 1.65

Balance at February 26, 2011 .......................... 7,078 1.12

Compensation expense related to all restricted stock grants is being recorded over a three year

vesting period of these grants. Non-employee director options granted, vest, and are subsequently

exercisable in equal annual installments over a three-year period. Beginning in fiscal 2011, stock units

granted to non-employee directors, vest 80% in year one, 10% in year two and 10% in year three. At

February 26, 2011, there was $4,951 of total unrecognized pre-tax compensation costs related to

unvested restricted stock grants, net of forfeitures. These costs are expected to be recognized over a

weighted average period of 1.85 years.

The total fair value of restricted stock vested during fiscal years 2011, 2010, and 2009 was $9,819,

$14,726, and $24,707, respectively.

95