Rite Aid 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

medicines to our pharmacies, and whether any customers who receive federally funded prescription

benefits (e.g. Medicare and Medicaid) may have benefited from those programs. We are in the process

of producing records in response to the subpoena and are unable to predict with certainty the timing or

outcome of the investigation.

We do not believe that any of these matters will have a material adverse effect on our business or

financial condition. We cannot give assurance, however, that an unfavorable outcome in one or more of

these matters will not have a material adverse effect on our results of operations for the period in

which they are resolved.

We are subject from time to time to various claims and lawsuits and governmental investigations

arising in the ordinary course of our business. While our management cannot predict the outcome of

these claims with certainty, our management does not believe that the outcome of any of these legal

matters will have a material adverse effect on our business, consolidated results of operations or

financial position.

Item 4. Removed and Reserved

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuers Purchases

of Equity Securities.

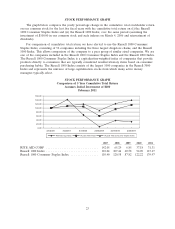

Our common stock is listed on the NYSE under the symbol ‘‘RAD.’’ On April 15, 2011, we had

approximately 26,643 stockholders of record. Quarterly high and low closing stock prices, based on the

composite transactions, are shown below.

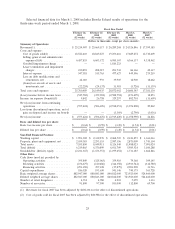

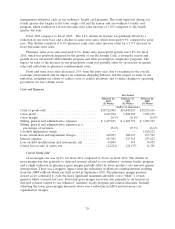

Fiscal Year Quarter High Low

2012 (through April 15, 2011) ...................... First $1.31 $0.98

2011 ........................................ First 1.74 1.08

Second 1.18 0.88

Third 1.10 0.87

Fourth 1.41 0.88

2010 ........................................ First 1.22 0.21

Second 1.74 1.22

Third 2.24 1.26

Fourth 1.66 1.26

We have not declared or paid any cash dividends on our common stock since the third quarter of

fiscal 2000 and we do not anticipate paying cash dividends on our common stock in the foreseeable

future. Our senior secured credit facility and some of the indentures that govern our other outstanding

indebtedness restrict our ability to pay dividends.

We have not sold any unregistered equity securities during the period covered by this report, nor

have we repurchased any equity securities, during the period covered by this report.

Our Chief Executive Officer certified to the NYSE on June 29, 2010 that he was not aware of any

violation by the Company of the NYSE’s corporate governance listing standards.

22