Rite Aid 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

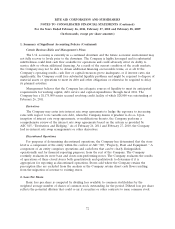

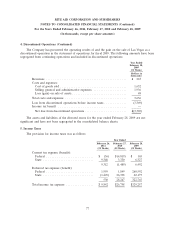

6. Accounts Receivable (Continued)

receivables securitization activity is reflected through October 26, 2009, the date of the termination of

the securitization facilities.

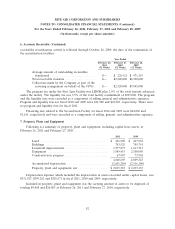

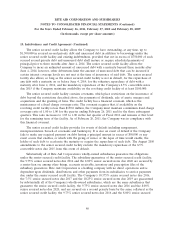

Year Ended

February 26, February 27, February 28,

2011 2010 2009

(52 Weeks) (52 Weeks) (52 Weeks)

Average amount of outstanding receivables

transferred .......................... $— $ 226,521 $ 471,319

Total receivable transfers ................. $— $2,240,000 $6,940,000

Collections made by the Company as part of the

servicing arrangement on behalf of the CPVs . $— $2,320,000 $7,045,000

The program fee under the First Lien Facility was LIBOR plus 2.0% of the total amount advanced

under the facility. The liquidity fee was 3.5% of the total facility commitment of $345,000. The program

and the liquidity fees were recorded as a component of selling, general and administrative expenses.

Program and liquidity fees for fiscal 2010 and 2009 were $11,980 and $24,903, respectively. There were

no program and liquidity fees for fiscal 2011.

Financing fees related to the Second Lien Facility for fiscal 2010 and 2009 were $24,882 and

$1,161, respectively and were recorded as a component of selling, general, and administrative expenses.

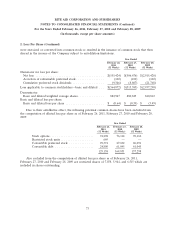

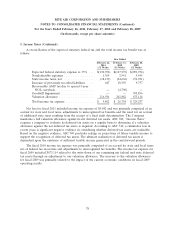

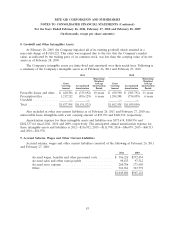

7. Property, Plant and Equipment

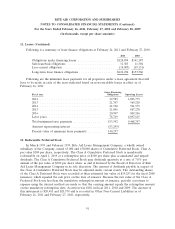

Following is a summary of property, plant and equipment, including capital lease assets, at

February 26, 2011 and February 27, 2010:

2011 2010

Land ...................................... $ 261,909 $ 267,938

Buildings ................................... 743,525 749,741

Leasehold improvements ........................ 1,577,873 1,617,713

Equipment .................................. 1,989,415 2,100,050

Construction in progress ........................ 67,947 73,901

4,640,669 4,809,343

Accumulated depreciation ....................... (2,601,286) (2,516,190)

Property, plant and equipment, net ................. $2,039,383 $ 2,293,153

Depreciation expense, which included the depreciation of assets recorded under capital leases, was

$331,927, $349,282 and $383,671 in fiscal 2011, 2010 and 2009, respectively.

Included in property, plant and equipment was the carrying amount of assets to be disposed of

totaling $4,608 and $26,003 at February 26, 2011 and February 27, 2010, respectively.

82