Rite Aid 2011 Annual Report Download - page 67

Download and view the complete annual report

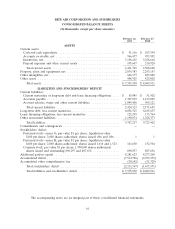

Please find page 67 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

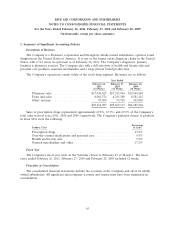

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

amount by which the carrying amount of the asset exceeds the fair value of the asset. When fair values

are not available, the Company estimates fair value using the expected future cash flows discounted at

a rate commensurate with the risks associated with the recovery of the asset.

Property, Plant and Equipment

Property, plant and equipment are stated at cost, net of accumulated depreciation and

amortization. The Company provides for depreciation using the straight-line method over the following

useful lives: buildings—30 to 45 years; equipment—3 to 15 years.

Leasehold improvements are amortized on a straight-line basis over the shorter of the estimated

useful life of the asset or the term of the lease. When determining the amortization period of a

leasehold improvement, the Company considers whether discretionary exercise of a lease renewal

option is reasonably assured. If it is determined that the exercise of such option is reasonably assured,

the Company will amortize the leasehold improvement asset over the minimum lease term, plus the

option period. This determination depends on the remaining life of the minimum lease term and any

economic penalties that would be incurred if the lease option is not exercised.

Capitalized lease assets are recorded at the lesser of the present value of minimum lease payments

or fair market value and amortized over the estimated useful life of the related property or term of the

lease.

The Company capitalizes direct internal and external development costs associated with

internal-use software. Neither preliminary evaluation costs nor costs associated with the software after

implementation are capitalized. For fiscal years 2011, 2010 and 2009, the Company capitalized costs of

approximately $4,759, $4,256 and $4,990, respectively.

Intangible Assets

The Company has certain finite-lived intangible assets that are amortized over their useful lives.

The value of favorable and unfavorable leases on stores acquired in business combinations are

amortized over the terms of the leases on a straight-line basis. Prescription files acquired in business

combinations are amortized over an estimated useful life of ten years on an accelerated basis, which

approximates the anticipated prescription file retention and related cash flows. Purchased prescription

files acquired in other than business combinations are amortized over their estimated useful lives of

five years on a straight-line basis.

Deferred Financing Costs

Costs incurred to issue debt are deferred and amortized as a component of interest expense over

the terms of the related debt agreements. Amortization expense of deferred financing costs was

$23,797, $20,789 and $13,410 for fiscal 2011, 2010, and 2009, respectively.

67