Rite Aid 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

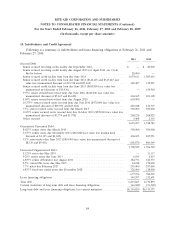

10. Indebtedness and Credit Agreement (Continued)

The senior secured credit facility allows the Company to have outstanding, at any time, up to

$1,500,000 in secured second priority debt and unsecured debt in addition to borrowings under the

senior secured credit facility and existing indebtedness, provided that not in excess of $750,000 of such

secured second priority debt and unsecured debt shall mature or require scheduled payments of

principal prior to three months after June 4, 2014. The senior secured credit facility allows the

Company to incur an unlimited amount of unsecured debt with a maturity beyond three months after

June 4, 2014; however, other debentures limit the amount of unsecured debt that can be incurred if

certain interest coverage levels are not met at the time of incurrence of said debt. The senior secured

facility also allows, so long as the senior secured credit facility is not in default, for the repurchase of

any debt with a maturity on or before June 4, 2014, for the voluntary repurchase of debt with a

maturity after June 4, 2014, and the mandatory repurchase of the Company’s 8.5% convertible notes

due 2015 if the Company maintains availability on the revolving credit facility of at least $100,000.

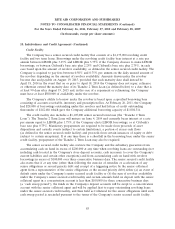

The senior secured credit facility contains covenants, which place restrictions on the incurrence of

debt beyond the restrictions described above, the payments of dividends, sale of assets, mergers and

acquisitions and the granting of liens. The credit facility has a financial covenant, which is the

maintenance of a fixed charge coverage ratio. The covenant requires that, if availability on the

revolving credit facility is less than $150.0 million, the Company must maintain a minimum fixed charge

coverage ratio of 1.00 to 1.00 for the quarter ending February 26, 2011 and for the three subsequent

quarters. This ratio increases to 1.05 to 1.00 in the last quarter of Fiscal 2012 and remains at that level

for the remaining term of the facility. As of February 26, 2011, the Company was in compliance with

this financial covenant.

The senior secured credit facility provides for events of default including nonpayment,

misrepresentation, breach of covenants and bankruptcy. It is also an event of default if the Company

fails to make any required payment on debt having a principal amount in excess of $50,000 or any

event occurs that enables, or which with the giving of notice or the lapse of time would enable, the

holder of such debt to accelerate the maturity or require the repurchase of such debt. The August 2010

amendments to the senior secured credit facility exclude the mandatory repurchase of the 8.5%

convertible notes due 2015 from this event of default.

Substantially all of Rite Aid Corporation’s wholly-owned subsidiaries guarantee the obligations

under the senior secured credit facility. The subsidiary guarantees of the senior secured credit facility;

the 9.75% senior secured notes due 2016 and the 8.00% senior secured notes due 2020 are secured by

a senior lien on, among other things, accounts receivable, inventory and prescription files of the

subsidiary guarantors. Rite Aid Corporation is a holding company with no direct operations and is

dependent upon dividends, distributions and other payments from its subsidiaries to service payments

due under the senior secured credit facility. The Company’s 10.375% senior secured notes due 2016,

the 7.5% senior secured notes due 2017 and the 10.25% senior secured notes due 2019 are guaranteed

by substantially all of the Company’s wholly-owned subsidiaries, which are the same subsidiaries that

guarantee the senior secured credit facility, the 9.75% senior secured notes due 2016 and the 8.00%

senior secured notes due 2020, and are secured on a second priority basis by the same collateral as the

senior secured credit facility, the 9.75% senior secured notes due 2016 and the 8.00% senior secured

86