Rite Aid 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

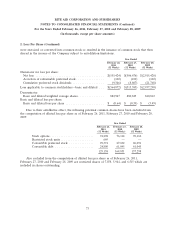

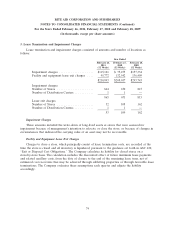

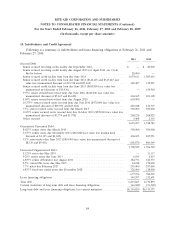

3. Lease Termination and Impairment Charges (Continued)

Long-lived assets are measured at fair value on a nonrecurring basis for purposes of calculating

impairment using Level 2 and Level 3 inputs as defined in the fair value hierarchy. The fair value of

long-lived assets using Level 2 inputs is determined by evaluating the current economic conditions in

the geographic area for similar use assets. The fair value of long-lived assets using Level 3 inputs is

determined by estimating the amount and timing of net future cash flows and discounting them using a

risk-adjusted rate of interest. The Company estimates future cash flows based on its experience and

knowledge of the market in which the store is located.

The table below sets forth by level within the fair value hierarchy the long-lived assets as of the

impairment measurement date for which an impairment assessment was performed.

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total Charges

for Identical Observable Unobservable Impairment February 26,

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date 2011

Long-lived assets held and used . . $— $21,822 $43,129 $64,951 $(114,330)

Long-lived assets held for sale . . . — 2,479 — 2,479 (791)

Total ...................... $— $24,301 $43,129 $67,430 $(115,121)

Quoted Prices in Significant Fair Values

Active Markets Other Significant as of Total Charges

for Identical Observable Unobservable Impairment February 27,

Assets (Level 1) Inputs (Level 2) Inputs (Level 3) Date 2010

Long-lived assets held and used . . $— $20,274 $4,262 $24,536 $(64,469)

Long-lived assets held for sale . . . — 14,927 — 14,927 (11,006)

Total ...................... $— $35,201 $4,262 $39,463 $(75,475)

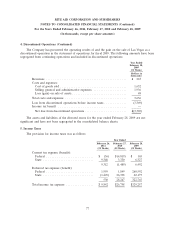

4. Discontinued Operations

During the fourth quarter of fiscal 2008, the Company entered into agreements to sell the

prescription files of 28 of its stores in the Las Vegas, Nevada area. The Company owned four of these

stores and the remaining stores were leased. The Company assigned the lease rights of 17 of those

stores to other entities and closed the remaining leased stores. The Company has sold three of the

owned stores and plans to sell the remaining one owned store. The sale and transfer of the prescription

files has been completed and the inventory at the stores has been liquidated.

76