Rite Aid 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

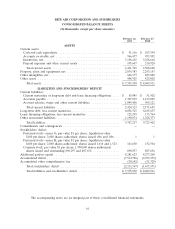

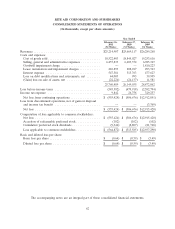

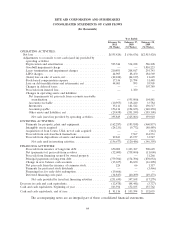

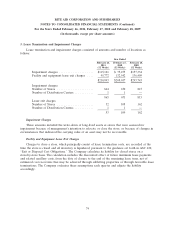

RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended

February 26, February 27, February 28,

2011 2010 2009

(52 Weeks) (52 Weeks) (52 Weeks)

OPERATING ACTIVITIES:

Net loss ......................................... $(555,424) $ (506,676) $(2,915,420)

Adjustments to reconcile to net cash (used in) provided by

operating activities:

Depreciation and amortization ........................ 505,546 534,238 586,208

Goodwill impairment charge ......................... — — 1,810,223

Lease termination and impairment charges ............... 210,893 208,017 293,743

LIFO charges .................................... 44,905 88,450 184,569

(Gain) loss on sale of assets, net ....................... (22,224) (24,137) 11,629

Stock-based compensation expense ..................... 17,336 23,794 31,448

Loss on debt modifications and retirements, net ............ 44,003 993 39,905

Changes in deferred taxes ........................... — — 307,789

Proceeds from insured loss ........................... — 1,380 —

Changes in operating assets and liabilities:

Net (repayments to) proceeds from accounts receivable

securitization ................................. — (555,000) 104,881

Accounts receivable .............................. (10,955) 118,240 33,784

Inventories .................................... 35,111 181,542 196,517

Accounts payable ................................ 156,116 (194,655) (140,258)

Other assets and liabilities, net ...................... (29,458) (201,249) (185,108)

Net cash (used in) provided by operating activities ....... 395,849 (325,063) 359,910

INVESTING ACTIVITIES:

Payments for property, plant and equipment .............. (162,287) (183,858) (460,857)

Intangible assets acquired ........................... (24,233) (9,772) (80,489)

Acquisition of Jean Coutu, USA, net of cash acquired ....... — — (112)

Proceeds from sale-leaseback transactions ................ — 7,967 161,553

Proceeds from dispositions of assets and investments ........ 29,843 65,177 33,547

Net cash used in investing activities ................. (156,677) (120,486) (346,358)

FINANCING ACTIVITIES:

Proceeds from issuance of long-term debt ................ 650,000 1,303,307 900,629

Net (payments to) proceeds from revolver ................ (52,000) (758,000) (11,000)

Proceeds from financing secured by owned property ......... — — 31,266

Principal payments on long-term debt ................... (779,706) (174,706) (870,054)

Change in zero balance cash accounts ................... (15,657) 86,650 (16,298)

Net proceeds from the issuance of common stock ........... 226 66 1,117

Payments for preferred stock dividends .................. — — (3,466)

Financing fees for early debt redemption ................. (19,666) — —

Deferred financing costs paid ......................... (34,847) (60,209) (49,473)

Net cash provided by (used in) financing activities ....... (251,650) 397,108 (17,279)

Decrease in cash and cash equivalents ...................... (12,478) (48,441) (3,727)

Cash and cash equivalents, beginning of year ................. 103,594 152,035 155,762

Cash and cash equivalents, end of year ..................... $ 91,116 $ 103,594 $ 152,035

The accompanying notes are an integral part of these consolidated financial statements.

64