Rite Aid 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

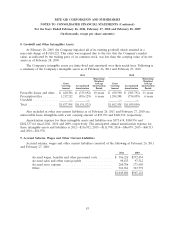

8. Goodwill and Other Intangibles Assets

At February 28, 2009, the Company impaired all of its existing goodwill, which resulted in a

non-cash charge of $1,810,223. This entry was required due to the fact that the Company’s market

value, as indicated by the trading price of its common stock, was less than the carrying value of its net

assets as of February 28, 2009.

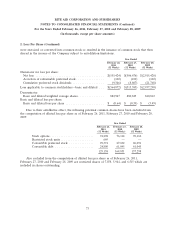

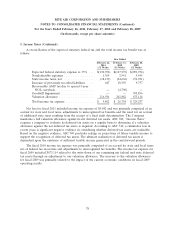

The Company’s intangible assets are finite-lived and amortized over their useful lives. Following is

a summary of the Company’s intangible assets as of February 26, 2011 and February 27, 2010.

2011 2010

Remaining Remaining

Weighted Weighted

Gross Average Gross Average

Carrying Accumulated Amortization Carrying Accumulated Amortization

Amount Amortization Period Amount Amortization Period

Favorable leases and other . $ 620,786 $ (335,692) 10 years $ 658,590 $ (305,791) 11 years

Prescription files ........ 1,217,212 (856,129) 6 years 1,204,348 (734,059) 6 years

Goodwill .............. — — — —

Total ................. $1,837,998 $(1,191,821) $1,862,938 $(1,039,850)

Also included in other non-current liabilities as of February 26, 2011 and February 27, 2010 are

unfavorable lease intangibles with a net carrying amount of $93,952 and $106,910, respectively.

Amortization expense for these intangible assets and liabilities was $173,618, $184,956 and

$202,537 for fiscal 2011, 2010 and 2009, respectively. The anticipated annual amortization expense for

these intangible assets and liabilities is 2012—$136,932; 2013—$111,798; 2014—$86,079; 2015—$68,715

and 2016—$56,970.

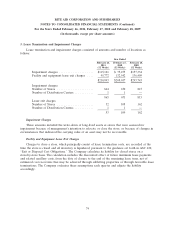

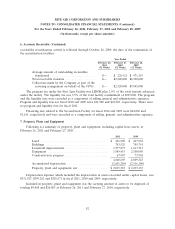

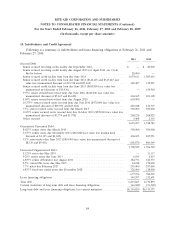

9. Accrued Salaries, Wages and Other Current Liabilities

Accrued salaries, wages and other current liabilities consisted of the following at February 26, 2011

and February 27, 2010:

2011 2010

Accrued wages, benefits and other personnel costs ........ $ 386,226 $372,434

Accrued sales and other taxes payable ................. 98,433 97,512

Accrued store expense ............................ 200,786 171,403

Other ........................................ 363,961 323,772

$1,049,406 $965,121

83