Rite Aid 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

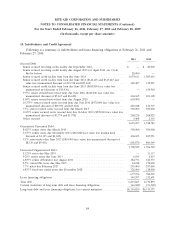

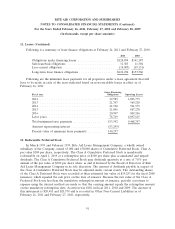

11. Leases (Continued)

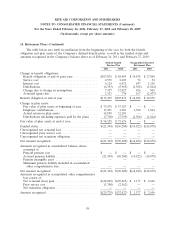

Following is a summary of lease finance obligations at February 26, 2011 and February 27, 2010:

2011 2010

Obligations under financing leases ..................... $128,994 $141,387

Sale-leaseback obligations ........................... 11,303 11,304

Less current obligation ............................. (18,003) (19,131)

Long-term lease finance obligations .................... $122,294 $133,560

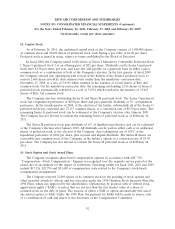

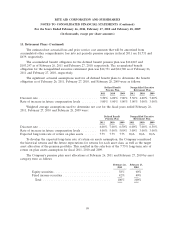

Following are the minimum lease payments for all properties under a lease agreement that will

have to be made in each of the years indicated based on non-cancelable leases in effect as of

February 26, 2011:

Lease Financing

Fiscal year Obligations Operating Leases

2012 ................................... 29,585 1,003,775

2013 ................................... 21,707 969,258

2014 ................................... 21,528 921,575

2015 ................................... 21,096 867,278

2016 ................................... 20,907 809,246

Later years ............................... 78,769 4,897,615

Total minimum lease payments ................ 193,592 9,468,747

Amount representing interest ................. (53,295)

Present value of minimum lease payments ........ 140,297

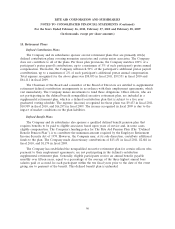

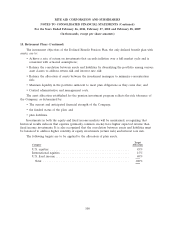

12. Redeemable Preferred Stock

In March 1999 and February 1999, Rite Aid Lease Management Company, a wholly owned

subsidiary of the Company, issued 63,000 and 150,000 shares of Cumulative Preferred Stock, Class A,

par value $100 per share, respectively. The Class A Cumulative Preferred Stock is mandatorily

redeemable on April 1, 2019 at a redemption price of $100 per share plus accumulated and unpaid

dividends. The Class A Cumulative Preferred Stock pays dividends quarterly at a rate of 7.0% per

annum of the par value of $100 per share when, as and if declared by the Board of Directors of Rite

Aid Lease Management Company in its sole discretion. The amount of dividends payable in respect of

the Class A Cumulative Preferred Stock may be adjusted under certain events. The outstanding shares

of the Class A Preferred Stock were recorded at their estimated fair value of $19,253 for the fiscal 2000

issuances, which equaled the sale price on the date of issuance. Because the fair value of the Class A

Preferred Stock was less than the mandatory redemption amount at issuance, periodic accretions to

expense using the interest method are made so that the carrying amount equals the redemption amount

on the mandatory redemption date. Accretion was $102 in fiscal 2011, 2010 and 2009. The amount of

this instrument is $20,481 and $20,379 and is recorded in Other Non-Current Liabilities as of

February 26, 2011 and February 27, 2010, respectively.

91